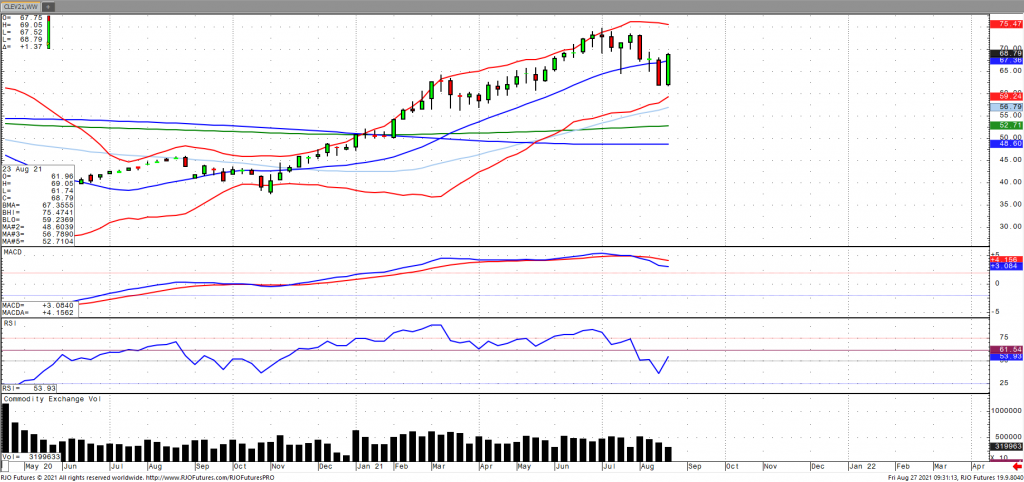

Oil prices are bouncing back after falling for the first time in four sessions amid renewed concerns of the impact of the delta variant on global recovery demand. Oi has reflated over 10% week over week as the USD has come off trend resistance with a strong inverse correlation developing with the USD of -0.71 on a 15-day duration. OPEC producers increased their exports during the first part of August, which was led by both Saudi Arabia and the UAE. Weekly EIA data showed inventories falling -2.98 million barrels, falling to lowest level since January 2020. Exports fell from last week to 2.812m bpd with refinery utilization up for the fourth consecutive week. Oil volitivity (OVX) has collapsed relative to last week down to the mid-30s with the market remaining bullish trend with today’s range seen between 62.11 – 70.92.