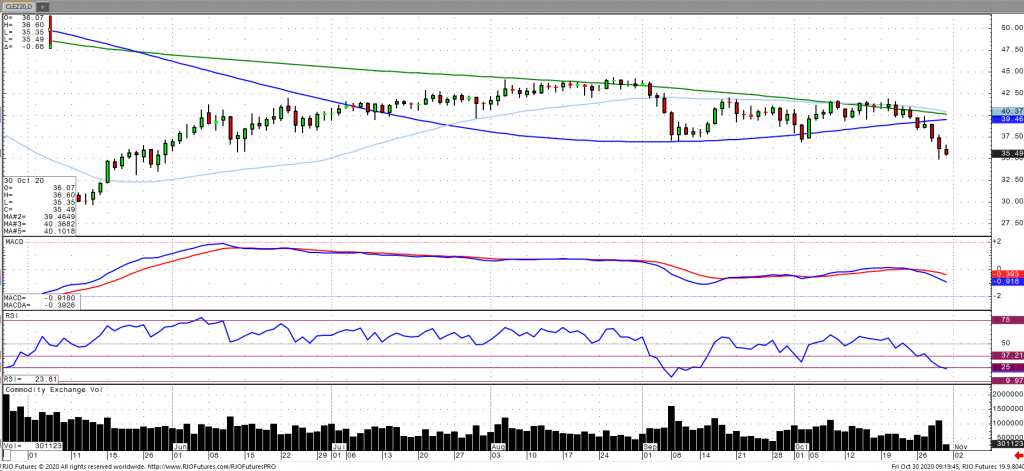

Oil prices are edging lower here in the early session, extending the weeks losses amidst a continuing surge in coronavirus cases throughout Europe and the United States as the market assess the impact on global consumption and fuel demand. France and Germany announced new lockdown measures on Wednesday, souring sentiment and adding to the already fragile demand outlook. OPEC+ are expected to raise output by 2 million bpd in January, despite top producers Russia and Saudi Arabia inclined to maintain the current output of 7.7 million bpd. This comes as Libya has continued to increase production and is expected to reach 1 million bpd in the coming weeks. OPEC+ are scheduled to meet Nov. 30 and Dec. 1 to assess policy. Weekly inventories showed a surprise increase according to the EIA, signaling ample supply despite gasoline consumption continuing to falter. Despite oil poised for its worst week since April, the volatility of oil is suggesting that the selling could be drying up on any renewed Dollar weakness. The market remains bearish trend with today’s range seen between 35.88 – 39.70.