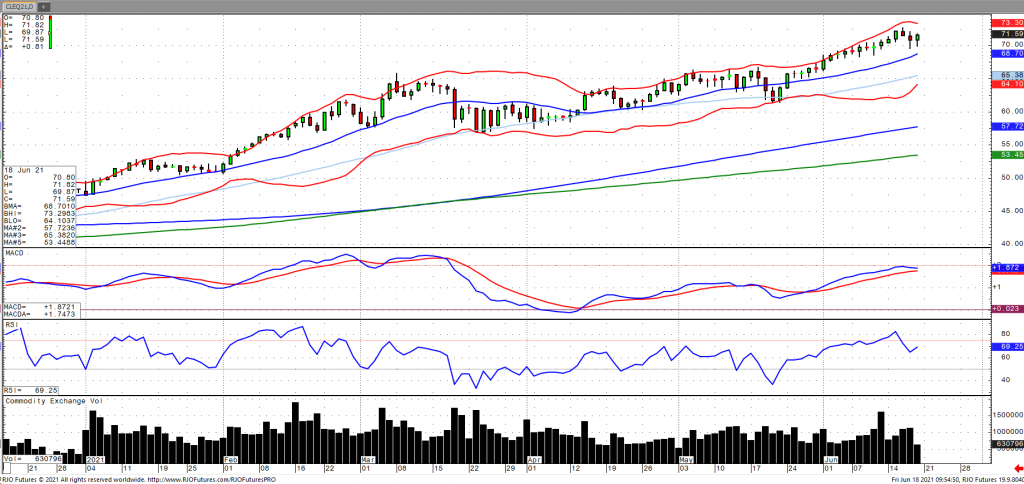

The oil market came under pressure from multi year highs on Thursday as the US Dollar rallied from a more ‘hawkish’ tilt by the Federal Reserve on Wednesday. Oil stockpiles fell sharply by 7.4 million barrels, according to the EIA, as refineries continued to increase operations (US refinery rate at 92.6%), suggesting further improvement in demand prospects. In addition, oil inventories in Europe have reported to have declined by 5.4% last week, lending to the idea of further tightening of global supply. Also lending support were reports that Chinese refinery throughput rose 4.4% in May from year ago levels. Iran is set to have presidential elections on Friday with the outlook for a flood of Iranian supply coming back online becoming increasingly more fleeting. The market remains bullish trend with today’s range seen between 68.66- 72.87.