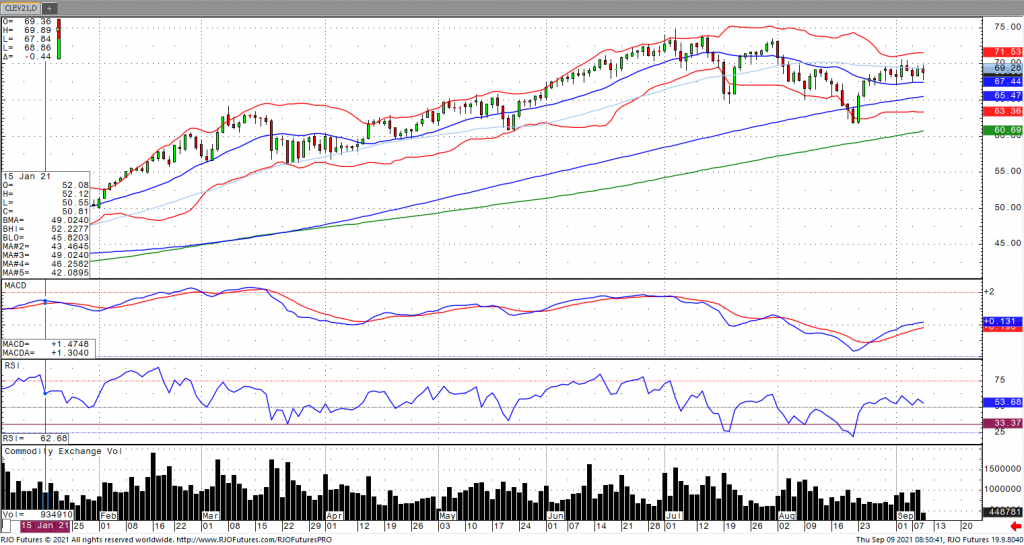

Oil prices are holding steady as of Thursday morning as demand concerns regarding the delta variant have been largely offset by production declines in the Gulf of Mexico. Reports are that only about 20% of oil production have returned, which equates to about 1.4 million barrels per day lost with the Gulf’s offshore wells making up 17% of US output. The EIA revised its 2021 oil production forecast by 200k bpd down to 11.08 million barrels per day. Weekly API data showed a smaller crude drawdown than expected with a greater than expected drawdown in gasoline and distillates. Oil still possess a strong inverse correlation on a 15-day duration with the US Dollar of -0.82 with the market remaining bullish trend as oil volatility (ovx) has fallen to the low 30s with today’s range seen between 67.21 – 71.36.