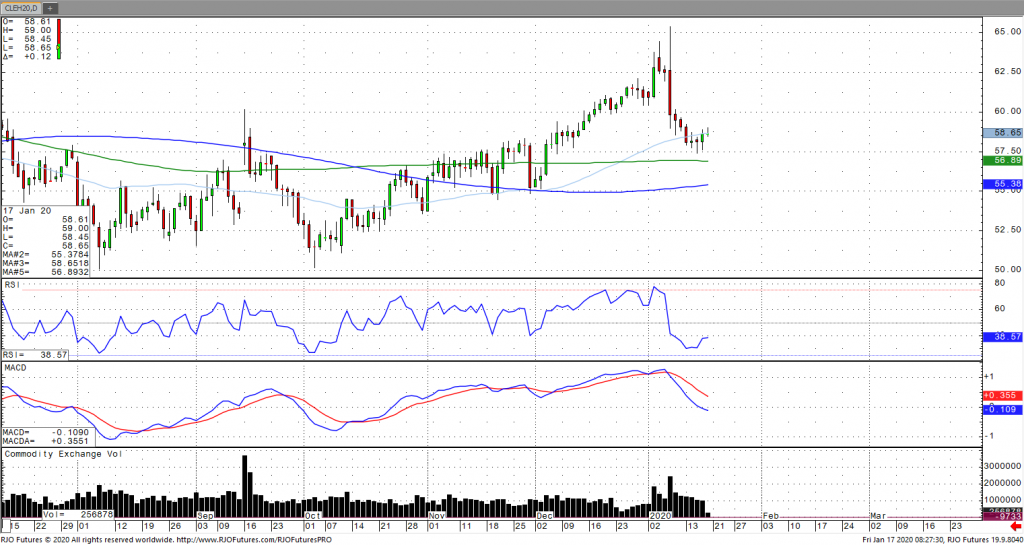

Oil prices are edging higher after rising more than 1% on Thursday following carryover optimism from the trade deal signing, signaling enhanced demand prospects. In addition, prices are receiving a lift this morning from positive Chinese industrial production and retail sales readings for December as well as reports that Chinese refineries processed an all-time high of 58.5 million tons of oil. This was coupled with Chinese December oil demand jumping close to 14% on year over year levels. This largely offsets reports that Libya increased oil production and Norway had stronger than expected oil output. The market discounted threat from Iran earlier this week, with Iran indicating that it will be enriching more uranium than under the 2015 Nuclear Agreement. Geopolitical risk remains unabated. Oil remains bullish trend with today’s range seen between 56.90 – 63.81.