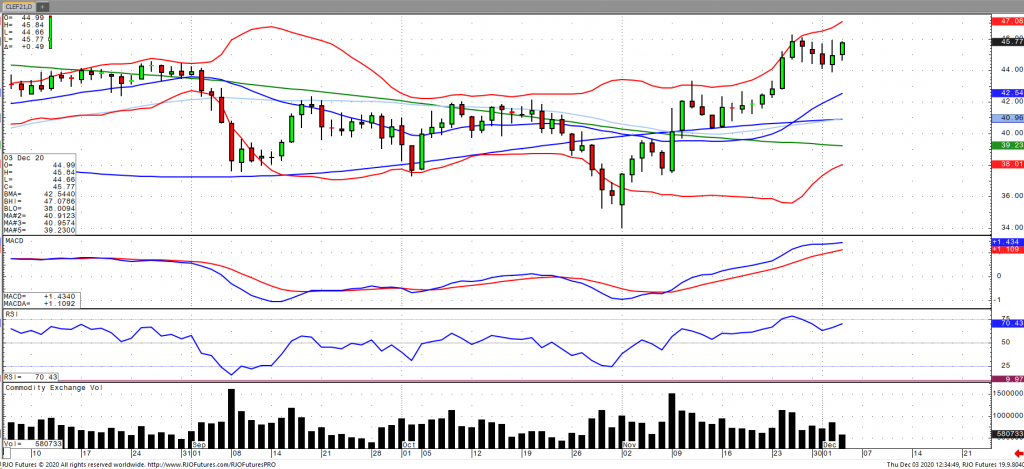

As of the Thursday afternoon session, oil prices have continued to edge higher following a multi-day retracement despite reports that OPEC+ have agreed to a collective output increase of 500k bpd next month ending a deadlock in discussion. The agreement was viewed as a form of cohesion following the impasse as the initial expectation was of a continuation of oil production cuts of 7.7 million bpd through March. The deal will be set proportionally with an agreement in place to review production each month as demand prospects continue to remain uncertain. This comes amidst a slight draw in EIA crude stocks and a surprise build of 4.1 million barrels in API crude stocks with a large increase in the weekly inflows of the product markets. The market may have been supported in by reports that the US exported nearly 3.5 million barrels last week, however, the refinery rate declined indicating a perhaps a setback in demand following the holiday uptick. The market remains bullish trend with today’s range seen between 42.07 – 47.11.