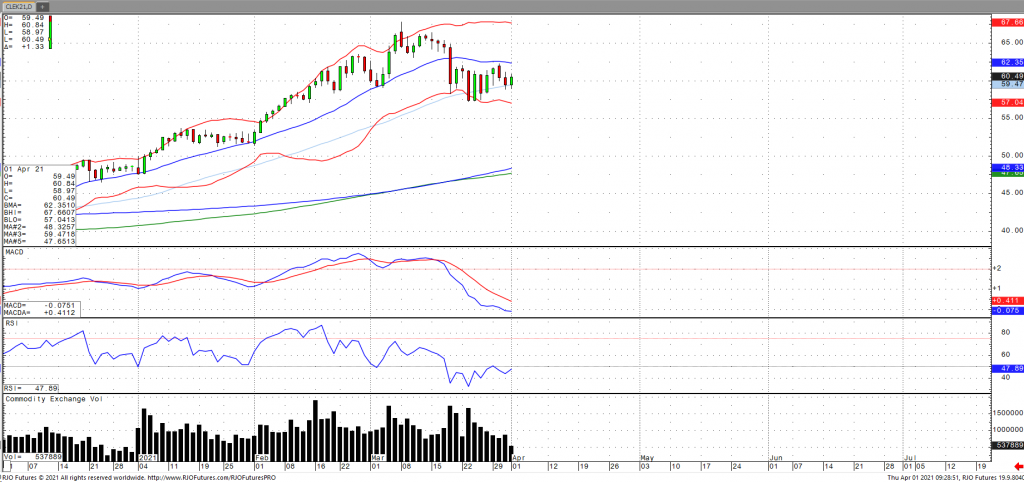

OPEC+ plus are set to decide on a rollover of production restraints through May as demand uncertainty continues to persist. This comes shortly after the reopening of the Suez Canal and amid the ongoing concerns regarding the coronavirus continuing to cloud the outlook, which may lead to the most likely outcomes of having production unchanged from April and for Saudi Arabia continue to withhold an additional 1 million barrels per day. This comes as OPEC+ earlier the week had a downward revision to its ‘demand growth forecast’. Crude stocks fell 876k barrels with the US refinery rate jumping once again for the third consecutive week, according to the EIA. Oil volatility (OVX) continues to fall and remain below trend (~48) with the market remaining bullish trend with today’s range seen between 57.67 – 65.06.