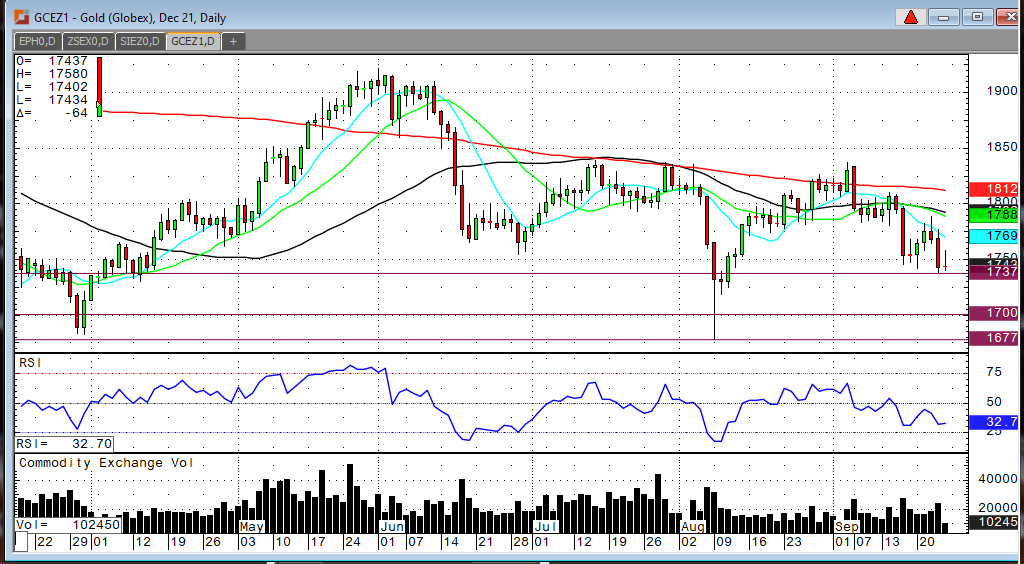

The gold chart is short term negative especially after this week’s recovery bounce and then sharp reversal down to $1,7375. A close under yesterday’s low of $1,7375 would open the potential for a washout back towards $1,700. However, while the Evergrande default has moved to the “back burner” for now, they did miss their interest payment due this week. The gold market is going to need something negative or risk off type event to rebound back above the $1,785 level. Until that time I remain bearish.Platinum had a huge rally this week from $900.00 to $1,0107 kissing that 200 DMA and then quickly retreating towards the $960.00 range.

Silver also experienced a bear market bounce this week and is again testing support at $22.00.

While precious metals temporally remain out of favor, metal traders cannot continue to write off prospects of longer-term inflation. Metals will find support. Remember that it is usually as simple as just finding a level on the chart that brings the buyers back!