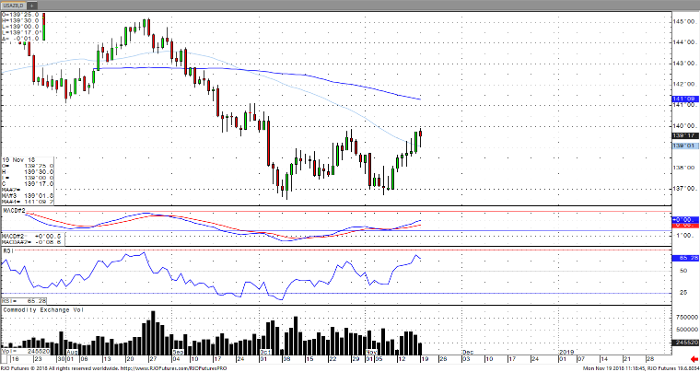

U.S. Treasury prices are continuing to trend higher after trading near 2-month highs as the yield on the 10-Yr note fell to 3.063% after coming off a seven year high of 3.232%. This comes amid Federal Reserve Chairman Powell’s comments last week that the central bank was monitoring a slowdown in global economic growth as it relates to U.S. growth. Powell noted there was a risk that U.S. growth could experience a slowdown as recent fiscal stimulus wears off and the U.S. dollar continues to surge, applying pressure on emerging market economies. Although Powell acknowledged the recent sell-off in the stock market has the potential to affect financial conditions, market conditions are “one of many factors” the Fed looks at and that it is unlikely to impact their stance on monetary tightening. This more “dovish” stance was emphasized on Friday after Fed Vice Chairman Clarida noted that it is important to continue to monitor the incoming data as interest rates continue to move closer to the ‘neutral level.’ Resistance for December bonds comes in around 139 – 25 with near term support seen at 138 -23.

30-Yr T Bond Dec ’18 Daily Chart