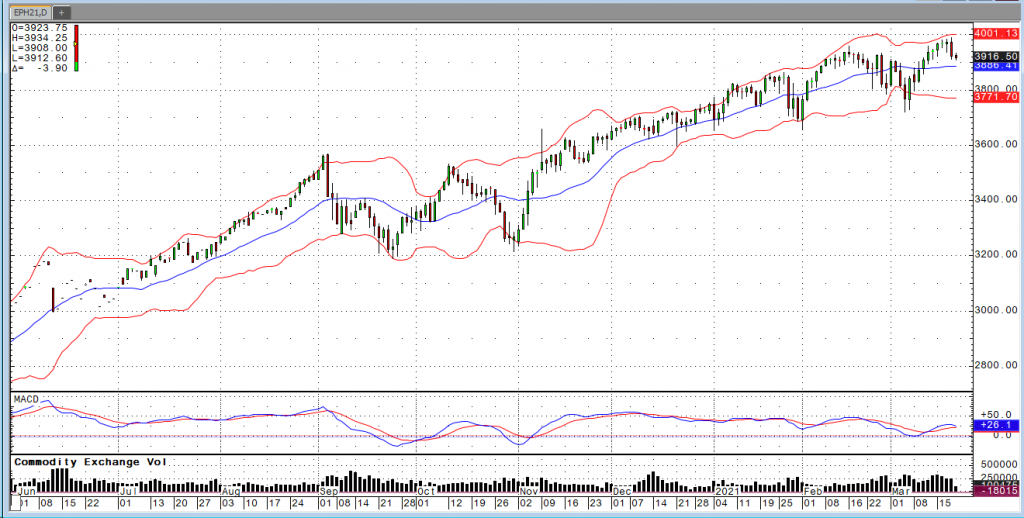

Markets continued to fall this morning as 10-year yields are flirting with 1.75%. Forecasts all seem to suggest we’ll see that figure north of 2.0% in relatively short order, which seems to have the equity markets a bit nervous. Fed Chair Powell addressed inflationary concerns earlier this week, suggesting that inflation figures may temporarily exceed their 2.0% target. However, they should tick back down to 2.0% next year before ticking back up to 2.1% in 2023. He also predicted that we’d see 6.5% GDP growth this year.

The indices were all lower to start the session, but things seem to be turning back up. The Dow is the weakest, while the Nasdaq and Russell have flipped green. The S&P is still down slightly. The news slate for today is virtually nonexistent, but traders will be looking forward to the home sales numbers on Monday and Tuesday as well as GDP on Thursday.