Good morning,

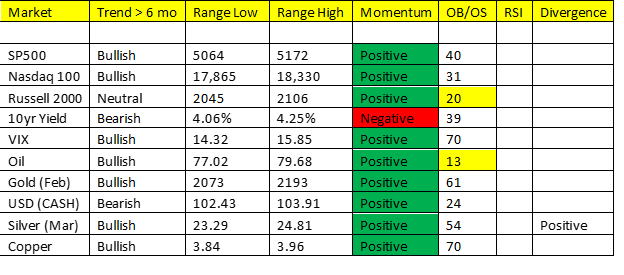

Market Risk:

*Key Reversal? – NVDA closes -8%, shed 10% in approximately 30 minutes in almost “penny stock” fashion ($2T mkt cap).

*Volatility: Greater than 15.00 this morning – head fake? Or the beginning of a regime change in VIX?

*Dollar doldrums: USD loses -1.0% last week, Gold gains +2.75% and Silver +2.99%, Copper +1.27%

*ECBs Kazimir: the ECB should wait until June with their first rate cut, rushing a move is not smart nor beneficial

*CPI: Consumer Price Index (US, and GER due out tomorrow)

Week over Week Commodity Performance:

Gold +2.73, Silver +2.99, Copper +1.27, Platinum +2.89%, Palladium +7.00% – Metals from my perspective have the landscape to be the best performers over the duration of 2024. Eyes on Silver and Copper from here.

Oil -1.14%, RBOB -1.80%, Nat Gas -6.16%

Corn +4.46%, Soybeans +2.01%, Wheat -5.04%

Coffee -6.26%, Sugar +4.47%, Cocoa -7.88%

Stocks: SP500 finished last week modestly lower to UNCH – OPEX on Friday and CPI tomorrow could portend some volatility in the tape this week. Also, we need to keep an eye on the BOJ meeting next week as they may signal a shift away from easy monetary policy by raising rates, and of course the FOMC following on Mar 20th. More immediate/intermediate term risk on the downside vs upside from here from my perspective. We have a correction pegged to begin late Mar thru May time period – could coincide with the BOJ policy shift.

Rates: We had the trend breakdown last week in the 10yr yield – of course tomorrows CPI data will be a market mover for interest rates. Beyond tomorrows headline inflation data, I expect rates to continue to grind lower from here and dare I say, we’ve seen the highs for the year in the 10yr yield.

Keep moving out there, back soon.