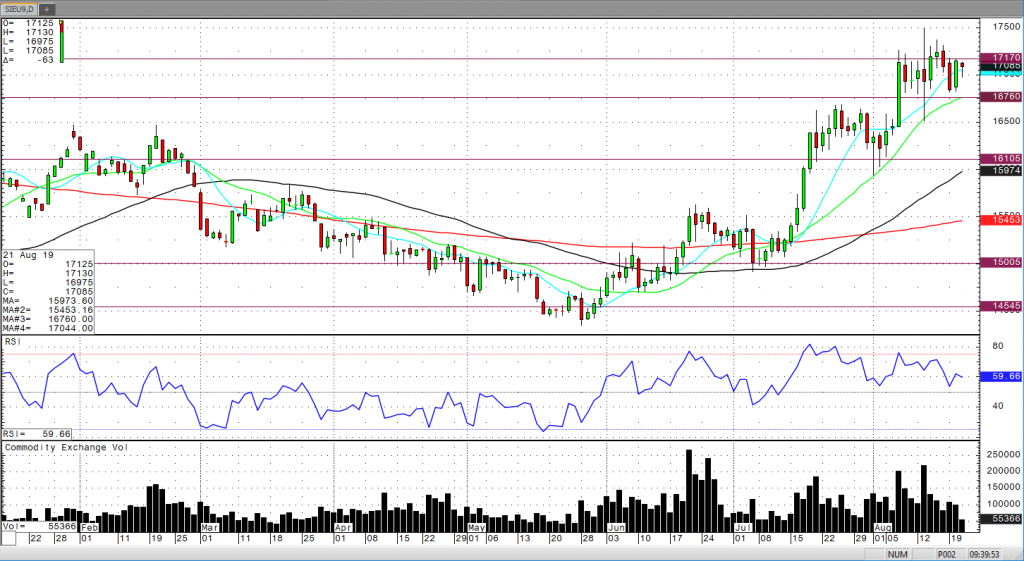

The silver futures market is in a consolidation mode. A choppy, sideways trading range between $16.80 and $17.25…roughly. This is where the market finds value until we get some direction from the Fed or the economic data. This holding pattern is still a bullish pattern. Likely just a pause before the next leg up towards the recent spike high at $17.50 and then off towards $18.00! But you know how it goes, a bull market needs to be fed a steady flow of bullish news. Additional rate cuts would be bullish for metals.

The only confusion or question now comes from “what will the Fed do”? The U.S. economy is doing pretty good and the “data” supports this statement. So, does our economy need more easy money stimulus? The answer in my opinion is no! Herein lies the problem. The global economy’s health relies heavily on the strength of the U.S. economy. We must keep our economy strong enough to lift or at least lend some support to most of the globe.

That is why I believe that the Fed will continue to reduce rates. That is where the silver market will get its catalyst to move towards $18.00. The Fed’s decision to cut rates again will give upward direction to precious metals.