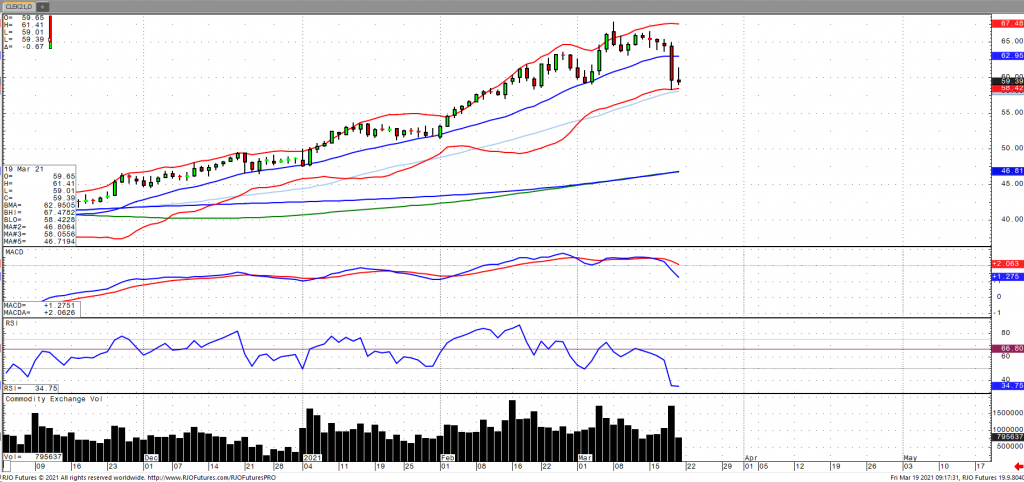

Oil prices have continued to edge lower early Friday following a precipitous drop of over 7% on Thursday amid slowing vaccination progress in Europe renewing concerns about the demand outlook. In addition, US crude inventories rose for the fourth consecutive week, with the EIA reporting a build of 2.4 million barrels. This recent buildup, however, will be eased by an increase in the US operating rate as refinery demand for spot crude ticks up. Other bullish developments include the expectation that Russian daily exports are expected to fall 3% in the 2nd quarter coupled with decline in Chinese stockpiles as well an increase in Chinese oil imports of 12% in February over year ago levels. Most importantly, with the recent spike in oil volatility (OVX) from 37 -48 is the ability to sustain below trend, which comes in around 48 and would suggest the spike is more ‘episodic’ and non-trending in nature. The market remains bullish trend with today’s range seen between 59.76 – 67.97.