Nearly two and a half months ago, I stopped just short of promising to eat my hat if we didn’t reach some kind of a deal before the August deadline. Here we are just a week and a half away from the election, and now I’m about as certain that nothing will get done leading up to the event. Granted I was wrong then, and perhaps I will be again. The left doesn’t want to give Trump any kind of a victory at this point. The right doesn’t want to throw as much money towards a package as Trump and the left are talking about into the mix. At this point, seeing will be believing, but the market seems to still have some confidence something will get done. I tend to agree, I just feel it will be after the election at this point (regardless of who comes out on top). They say markets are forward looking, and that appears to be the case right now.

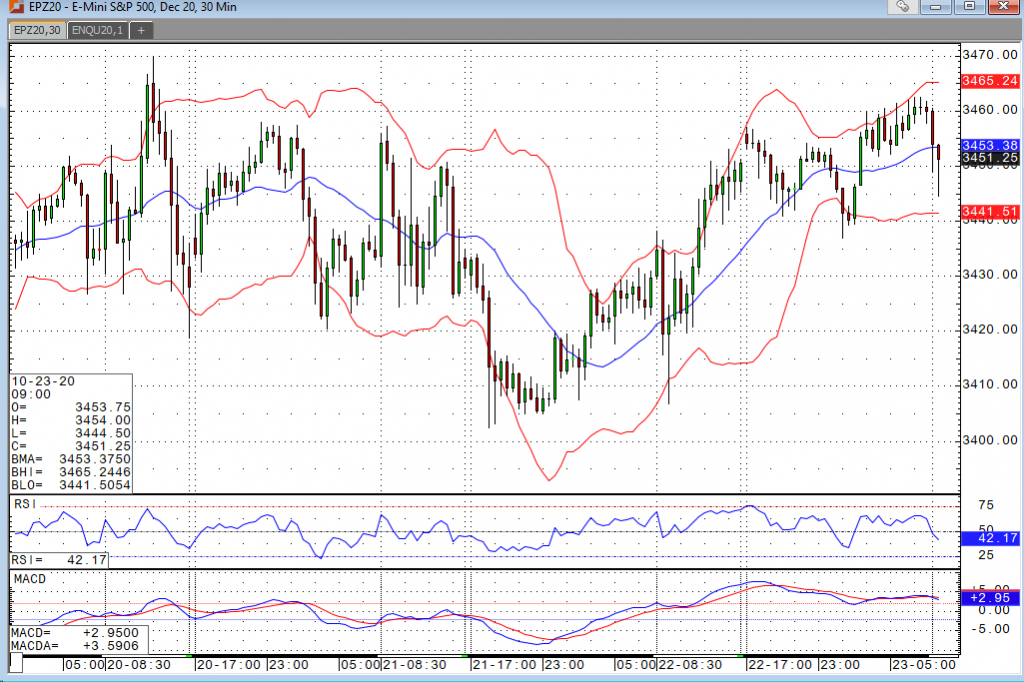

Stocks are slightly lower to start things off today in what has been a pretty quiet week. The S&P futures have spent nearly all of the past few sessions trading within a 30 tick range (3425-3455) after failing to reach a new all-time high last week. Given all of the gridlock and uncertainty out there, one has to be impressed that the market continues to hold firm. Many investors seem to be raising cash heading into the election, but I believe they’ll be looking to reallocate those funds into the market should we get a selloff of any significance. Coronavirus cases seem to be spiking again across the globe, and lockdown discussions are back in the news. I doubt we’ll see another selloff of the magnitude we saw in the first quarter, but I continue to feel that dips are buying opportunities.