It appears the V-shaped recovery we were witnessing over the last few days is taking a bit of a break. Coronavirus news continues to roll in. There’s been some positive news, some negative news, and a whole lot of hysterics. Of note, it was reported earlier that British PM Boris Johnson has tested positive. He says that his case is mild, and that he’ll continue to fulfill his duties via video conferencing while in quarantine. There’s enough news out there to feed whatever narrative you prefer. However, it’s times like these where I think it’s important to take it all in and realize that the truth likely lies somewhere in the middle. There are a decent number of unknowns out there, there will be one off cases, but we seem to have a pretty good grasp as to who is most at risk. Be safe out there.

The other big story continues to be our government’s inability to come together and get a bill passed. We’ve been hearing things like it’s on the two-yard line and that passage is imminent for days now. One would think that given the circumstances we would be able to get to the heart of the matter and argue politics later. That’s evidently too much to ask for as we’re still arguing over pork spending, completely unrelated political agendas being slipped into the bill, etc.

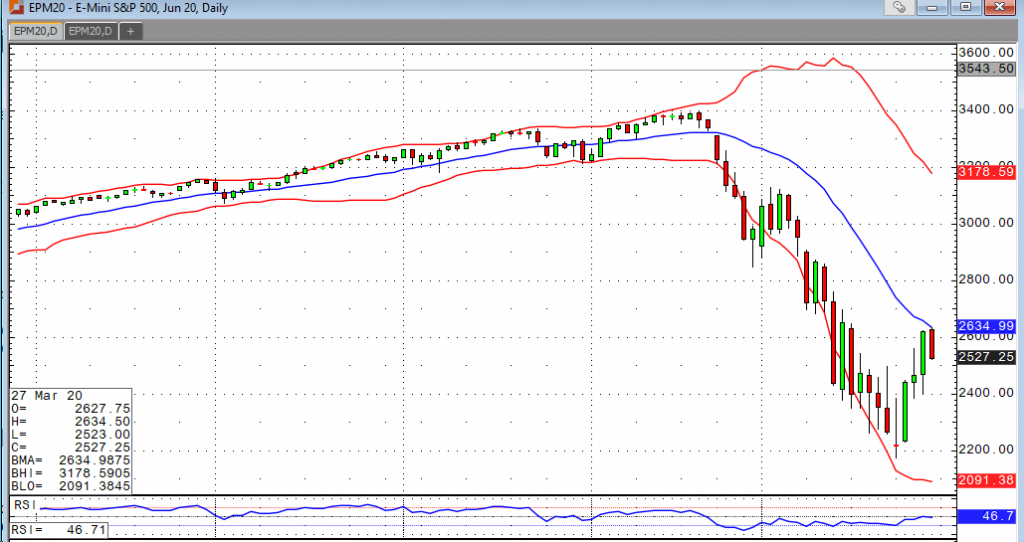

The stock indices are taking it on the chin this morning, with the Dow futures down about 700 or about 3% heading into the open. I expect some choppy to lower trade as we see some profit taking heading into the weekend along with continued uncertainty about the bill. The rally has been wonderful to quell some of the panic, but I do believe the discouragement phase is likely to come. Whether or not that results in a new low remains to be seen, but I expect it will result in a tremendous buying opportunity at some point.