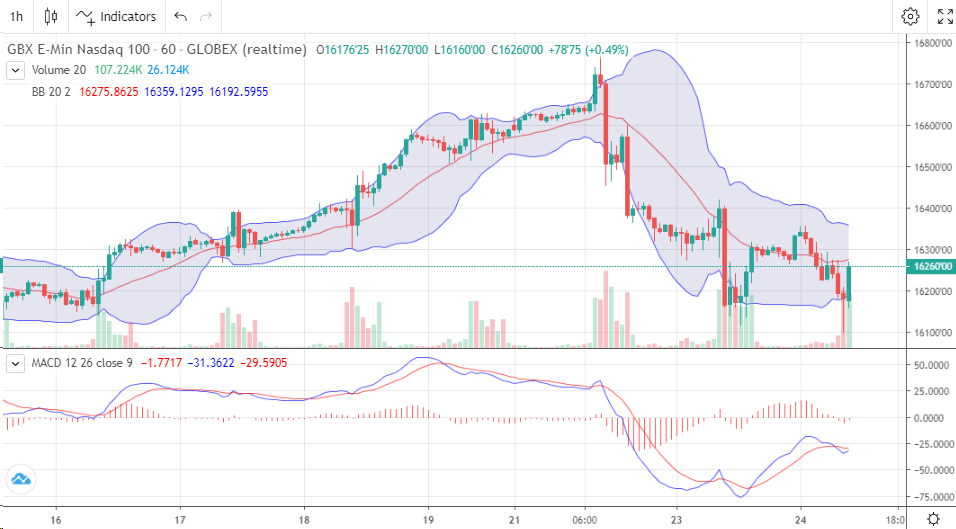

All four indices are lower to kick off the week’s last full day of trading. While the Russell and Nasdaq managed to make new lows for the move, the Dow and S&P have failed to do so. Tech has led the way down as bond yields are on the rise once again. Lockdowns are back in some corners of the world due to surges in coronavirus cases. Inflation also seems to be a bit stickier than some would have guessed. Factor in that Powell is still driving the bus at the Fed (Brainard would have likely been more dovish), and you’ve got some ingredients for a selloff. With all that in mind, we’re dipping into oversold territory in the Russell. The Dec VIX is trading above 21, and while that doesn’t mean it can’t go higher, it has struggled to tread water at these levels for any meaningful amount of time.

Trading hours are cut short tomorrow and Friday for Thanksgiving. We’ve got a few important data releases next week including PMI on Tuesday and the jobs data on Friday. Happy Thanksgiving to you and yours.