U.S. equity markets are drifting between gains and losses in the early session as investors are beginning to weigh second quarter earnings after Citi group reported better than expected profits and revenue but mixed results in the trading division. This comes following the release of Chinese data indicating that China’s economic growth decelerated to its slowest pace since 1992. Growth decelerated to 6.2% in the second quarter, down from 6.4%, with Asian exports, Japanese machine tool orders and Singaporean GDP confirming the lower bias. Expectations are for Beijing to continue to ease monetary policy to encourage lending following the implementation of tax cuts and fees (2 trillion yuan) in March to stimulate their economy. The S&P 500 has extended to yet another high in a continuing uniform uptrend and remains bullish trend, yet is signaling immediate term overbought with today’s range seen between 2939 – 3019.

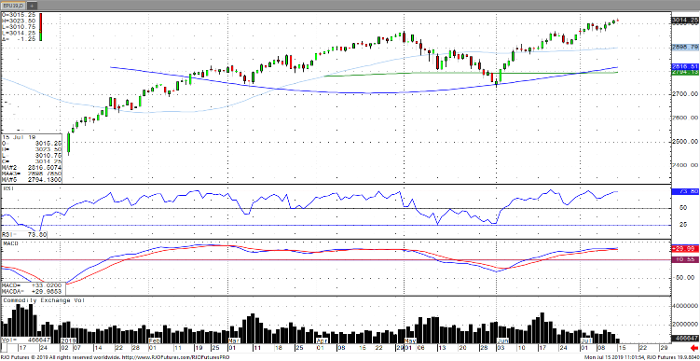

E-Mini S&P 500 Sep ’19 Daily Chart