All the major indices are in the green by a slightly healthy margin to kick things off this morning. The day’s slate of data is about as light as it gets, but we do have several Fed members speaking in New York. Given that we’re just coming off the minutes on Wednesday, I would be surprised by any major revelations from their roundtable and speeches. Next Tuesday and Wednesday, Fed Chair Powell will be in Washington to deliver the semiannual monetary report, which will likely have a bit more substance.

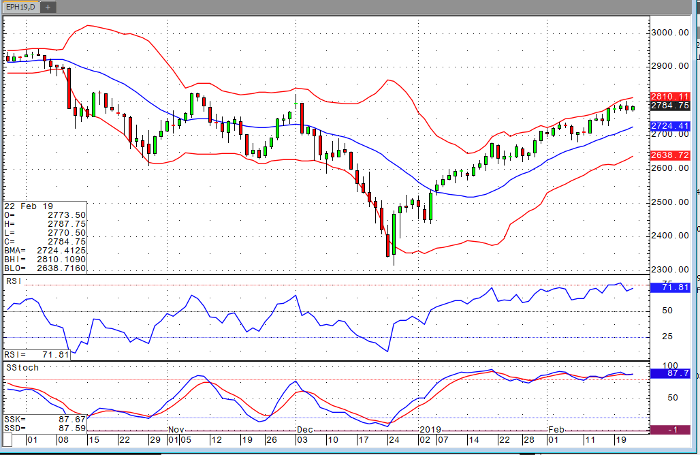

From a technical standpoint, the mini S&P is charging higher, but may run into issues between the 2795-2820 levels. While we’ve traded in that range a number of times after the initial sell-off in October, rallies have repeatedly failed and have been followed by significant selloffs. The rally from the early December lows has been strong, regaining about 75% of the losses from the highs. Volume hasn’t been all that inspiring as of late, but it’s hard not to respect the gains we’ve seen in a relatively short period of time.

E-Mini S&P 500 Mar ’19 Daily Chart