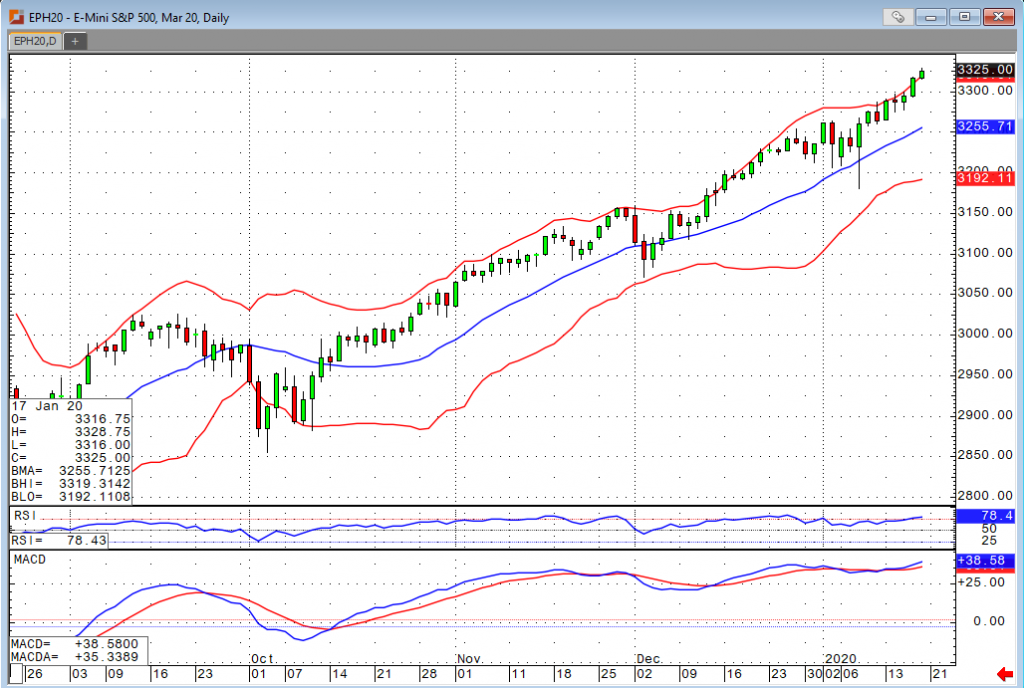

All four of the major U.S. indices printed fresh new highs preopen. While we’re certainly seeing some overbought readings, I’m also showing several momentum studies that still project even higher prices. Technical trading becomes a bit more difficult now that we’re literally in uncharted territory, so keep an eye on the news concerning China, developments about a possible deal with the EU, and of course, earnings. Today’s slate of data is relatively light, but we saw a nice housing starts number earlier. We were expecting to see the starts figure come out at 1.373, but we posted an impressive 1.608M. Permits, on the other hand, were in range but slightly below consensus. We’ll be looking forward to the consumer sentiment data as well. It is expected to come in strong at 99.3.

Many of the markets have short hours or are closed altogether on Monday in observance of Martin Luther King Jr. Day. The rest of the week’s slate of data is very light, but earnings should make things a bit more interesting. Traders will be looking forward to the following week when the FOMC gets together for a two-day meeting on 1/28 & 1/29. We’re not expecting any cuts or hikes, but we’ll be looking for clues into potential for either moving forward. For what it’s worth, the FOMC said last month that they’re not forecasting any more cuts for the foreseeable future. With other central banks continuously lowering their rates, I personally find that a bit hard to believe. That said, I do think any cuts we’ll make will be a bit more reactionary than proactive.