All four major indices are slightly lower in the wake of the opening bell. The data slate today is very light, but traders will continue to monitor the headlines for news on China, Brexit, and the situation along the Syrian border. Several of the Federal Reserve members will be speaking, but I’m not sure they’ll say anything that will really move the needle. Next week’s slate is also on the lighter side until Thursday when things start picking up again. Absent news, previously mentioned headlines, and talk about what the Fed will do at month’s end should dominate the conversation. As of now, it appears the Fed is on pace to cut another quarter basis point.

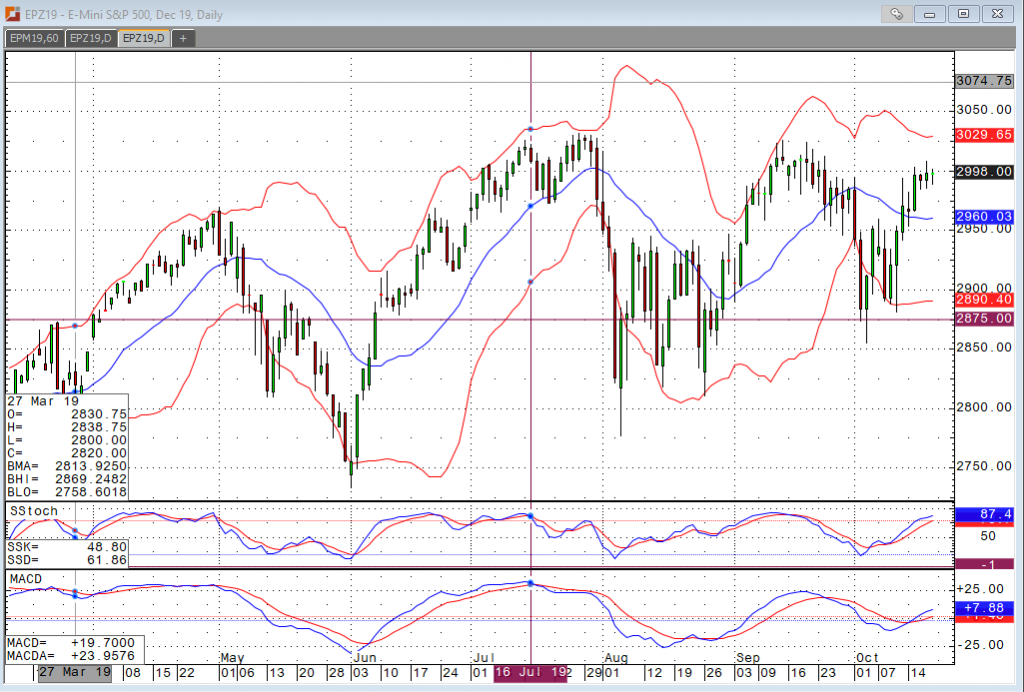

The S&P still looks strong but is struggling to build on the gains we saw last week into some overhead resistance. News could provide the spark needed to drive it higher, but I’m not holding my breath for a China deal anytime soon. Earnings season is still in full swing, so any big surprises there could also give the market the nudge it seemingly needs to move off this 3000-level.