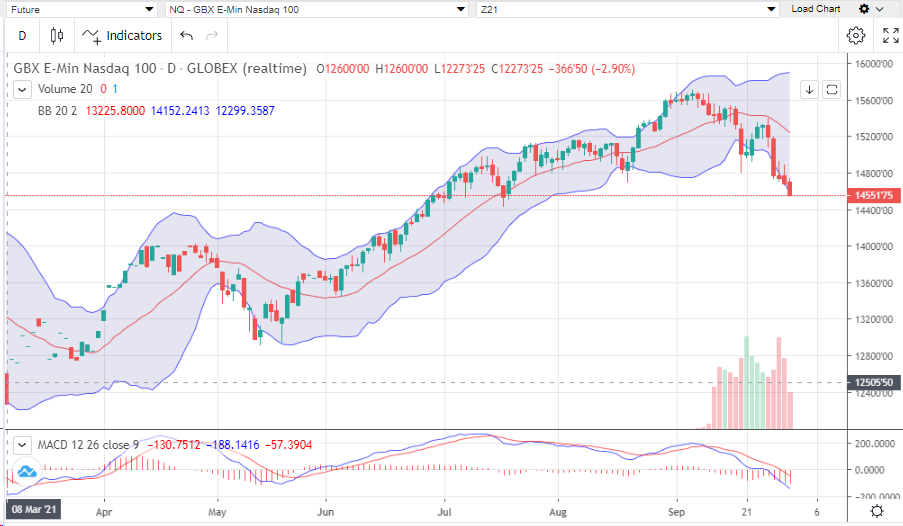

Global equities were lower overnight, and domestic markets seem to be struggling to hold onto some signs of strength early in the day. All four indices have made new lows for the week. Rising yields have been hammering tech stocks, and the Nasdaq is now off it’s all-time high by a bit over seven percent. In addition to yields, supply chain issues are piling up, and the forecasted timelines for them to get straightened out are not encouraging. A more hawkish Fed has the dollar rallying, Chinese crackdowns, debt ceiling issues (likely just political theater for now) persist, and what’s looking to be a rough road to passage on the next infrastructure bill have also managed to pump the brakes on what’s been a tremendous rally.

While there’s a fair share of doom and gloom out there, the Nasdaq is still up thirteen percent on the year following this drop. Many medical professionals are suggesting Delta has peaked, and there was tremendous news from Merck and Ridgeback Biotherapeutics. Evidently they’ve developed a pill that has greatly reduced symptoms and death amongst the high risk population when administered shortly after showing symptoms.