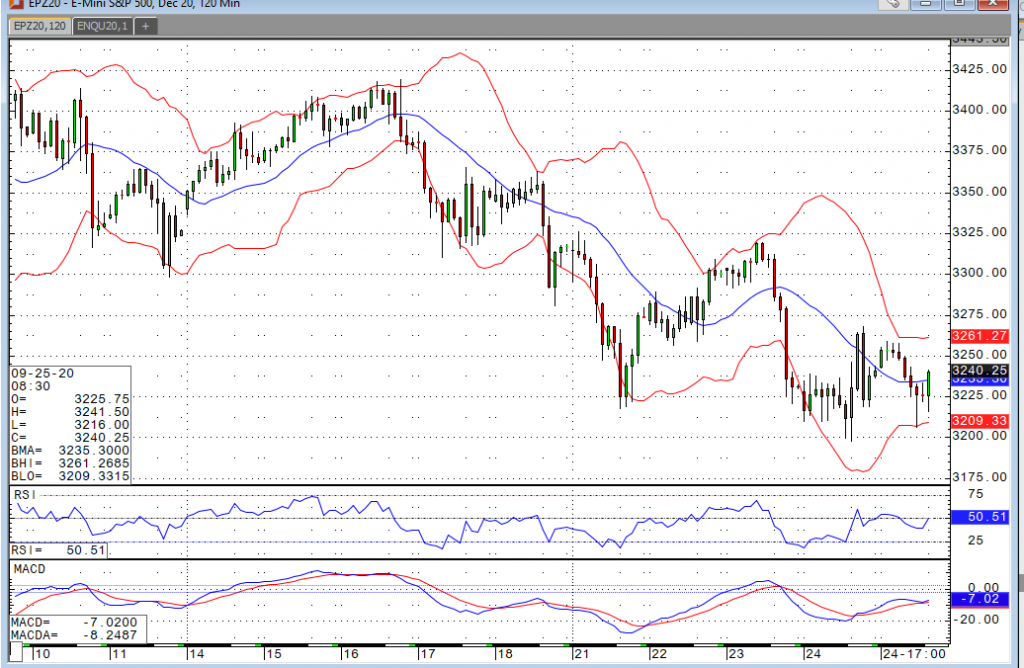

The S&P 500 traded down to the 3210 support level in the wee hours of the morning but has managed to recover nicely. Hopes and rumors of an actual deal on further stimulus have not been able to rally the market, but it looks like it has at least been enough to pump the breaks on the selloff. After those in Washington let the deal deadline pass two and a half months ago, we’ve heard little to suggest the two sides have gotten any closer. However, the tune seems to have changed a bit over the past few days. While talks are ongoing, early indications suggest the two sides are still a trillion dollars apart. We’ll continue to monitor the news for any progress on the matter. For the time being, the market seems to want some actual substance before we see any uptick.

The market is sitting just below the 50% retracement between the 6/29 low and 9/2 high. I believe this level will prove to be support should we make any actual progress towards passing another stimulus package, but politics are ramping up as we head down the final stretch of the election. Absent some kind of a deal, I see 3105 as the next level of support. Either way, it should be a wild five and a half weeks leading up to the election.