The bar was set pretty low, but this month’s non-farm payrolls came out considerably better than last month’s number. Traders were looking for something in the neighborhood of 180K. The number came out at 197K. They also revised last month’s abysmal reading of 20K up to 33K, which I suppose is better than nothing. Stocks are up slightly following the news. For those looking for a test of October’s all-time highs, it appears they’ll have to rely on other news to really get us moving.

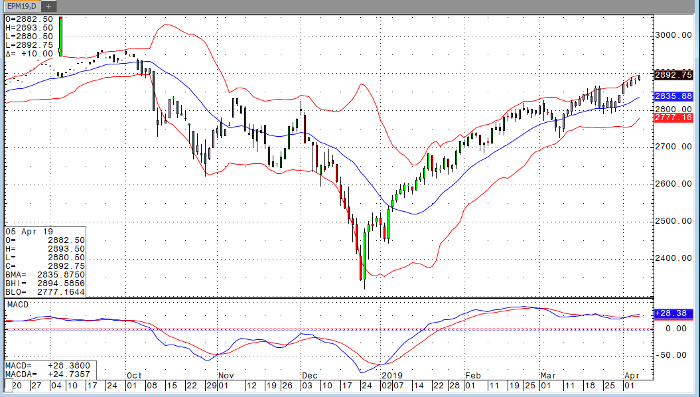

The market is a bit overbought, but the trend remains strong to the upside. The mini S&P has now closed above the critical 2820 level in six consecutive sessions. We’ve also heard some positive developments in the ongoing China negotiations, and I think that that has eased traders’ concerns. We’ve heard plenty of optimism from President Trump on the negotiations, but we’re actually starting to hear the other side echo his statements for the first time. That said, we’re still likely another 3-4 weeks out at a minimum on anything concrete.

E-Mini S&P 500 Jun ’19 Daily Chart