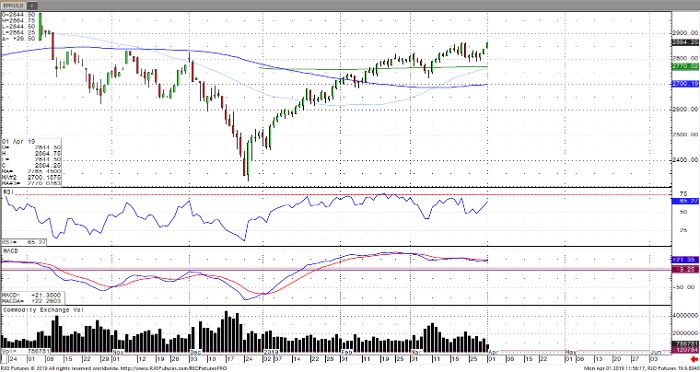

U.S. stocks followed global equity markets higher after better than expected Chinese economic data was released in the overnight. Caixin Chinese manufacturing PMI came in at 50.8, which is slightly above the 50.0 growth threshold, coming off after hitting its lowest point in three years in February. This contradicts reports from major manufacturers including Germany, Japan and South Korea. Positive trade developments including Chinese willingness to continue to suspend tariffs on US vehicles may provide some underlying support. The June E-Mini S&P 500 gapped higher in the overnight and is trading near the mid-March range high of 2866. The market remains bullish trend but near overbought levels with today’s risk range seen between 2785 – 2858.

E-Mini S&P 500 Jun ’19 Daily Chart

If you would like to learn more about S&P 500 futures, please check out our free Trading E-mini S&P 500 Futures Guide.