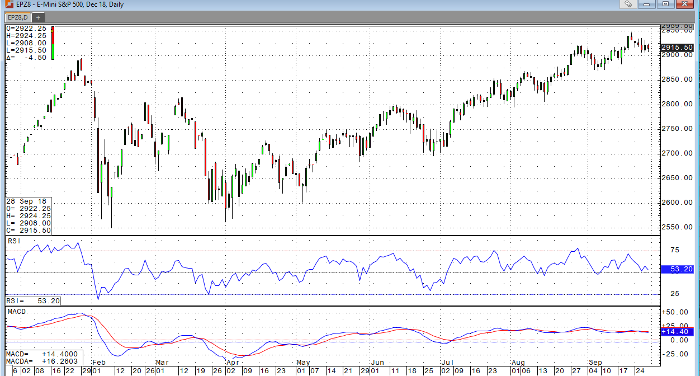

Stock indices are all about a quarter percent lower to kick off today’s session. Since printing a new all-time high last Friday, the S&P has put in a downward sloping channel of lower highs and lower lows. That said, we seem to have found some measure of support around the 2908.00 level. We have bounced off that level for a third time prior to today’s opening bell and have recouped a good portion of the overnight losses. Data has been supportive and it seems as if trade deals with China and Canada are still possibilities, which have lent support to the indices. There were no surprises from the FOMC meeting on Wednesday, so it is not surprising to see the market maintain these lofty levels.

Next week’s news will be highlighted by PMI, ISM, and the jobs data. It will also feature a number of members of the FOMC speaking on various topics, but I’m not sure their remarks will move the needle much more than anything we heard on Wednesday.

E-Mini S&P 500 Dec ’18 Daily Chart