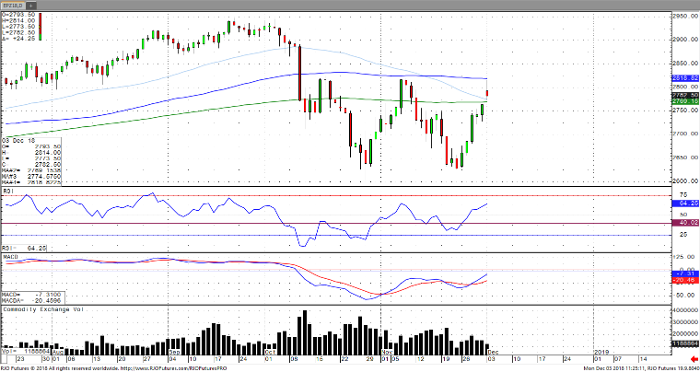

U.S. equity markets followed Asian markets higher following reports that President Trump and President Xi of China have agreed to suspend further implementation of tariffs for the duration of 90 days. In addition, China has agreed to cut tariffs on American cars from 40%, as well purchase added agricultural, industrial and energy products. This relief rally comes amidst concerns about trade, falling oil prices, as well slowing global growth. The delay on tariffs will allow negotiators to focus on broader issues including intellectual property protection, U.S. access to Chinese market, and cyberespionage. The market will be looking ahead to the conclusion of the Fed policy meeting on December 19th as the Fed is looking to pull back its policy on monetary tightening. Near term support for the S&P 500 comes in around 2775 with resistance near the 100 day moving average of 2818 with the next upside target seen at 2866.

E-Mini S&P 500 Dec ’18 Daily Chart