Weakness in Asian markets drove the indices down considerably last night. Concerns over tensions between China and the United States and China and Hong Kong were the main reasons behind the selloffs. While the Hang Seng losses reached over 5.5%, the domestic equity markets have bounced back nicely. The S&P, Nasdaq, and Russell are all considerably off their lows and briefly found themselves back in positive territory. The Dow remained slightly negative but more than 200 off its overnight low. The recovery is pretty impressive as the weakness easily could have spurred significant profit taking ahead of the long weekend. The market continues to discount much of the horrid economic data, and with reopenings on the rise, those figures should improve. The re-opening process could also lead to a spike in deaths and infections as a result of increased COVID exposure, but there seems to be some reasons for optimism out of states that are already a bit further along in the process.

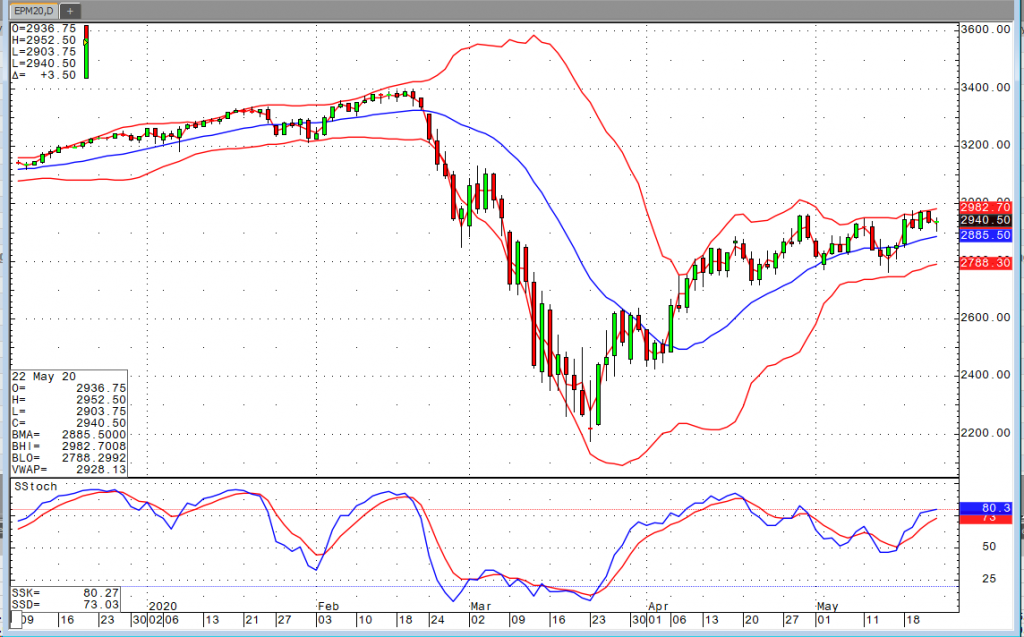

Technically speaking, the mini S&P continues to struggle with the 200 DMA. Yesterday’s action marks yet another rejection at the 2960 level. The upside momentum is tapering off a bit, and we seem to have established a bit of a sideways to higher channel over the past several weeks. If we’re able to test the lower end around 2800-, I would probably consider looking at ways to speculate further upside.