Throughout the United States and Europe, lockdowns are turning from a conversation to a reality. We know the toll that such actions took on the market last time, but we’re considerably more well informed about the virus than we were several months ago. Cases are surging again, and while some will suggest that is largely a function of increases testing, it is hard to view that as a positive. Lockdowns are at the very least, unlikely to help the recovery we’ve seen from the March lows, but we’re also nearing the finish line on multiple vaccines. When you factor in that we’re unlikely to see any form of additional stimulus for the next couple months, one can only be impressed by how well the market has maintained these trading levels.

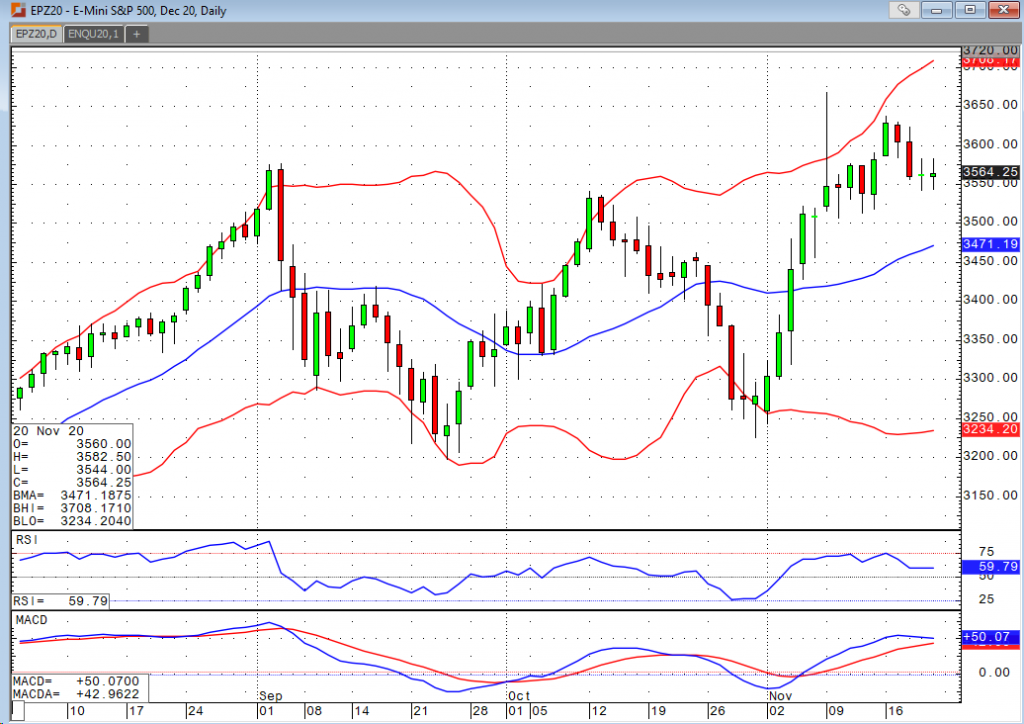

The Dow, S&P, and Nasdaq continue to trade near the top end of their recent ranges dating back to early September. The Russell lagged the others on the way up (and was often the first to show signs of weakness on downturns), but it arguably has the strongest technicals of the bunch. All four indices are slightly lower this morning, but that’s not all that surprising given some of the risk factors on the fundamental front. We’re also headed into a holiday week, so some investors may just want to take their profits off the table and enjoy their time off. We’ve ramped up into the close three of the four days this week, so clearly the dip buyers are still out there. Considering how many people seem to be interested in buying lower, and the market’s tendency to please the least amount of investors, I believe we’re likely to remain relatively elevated in the near future.