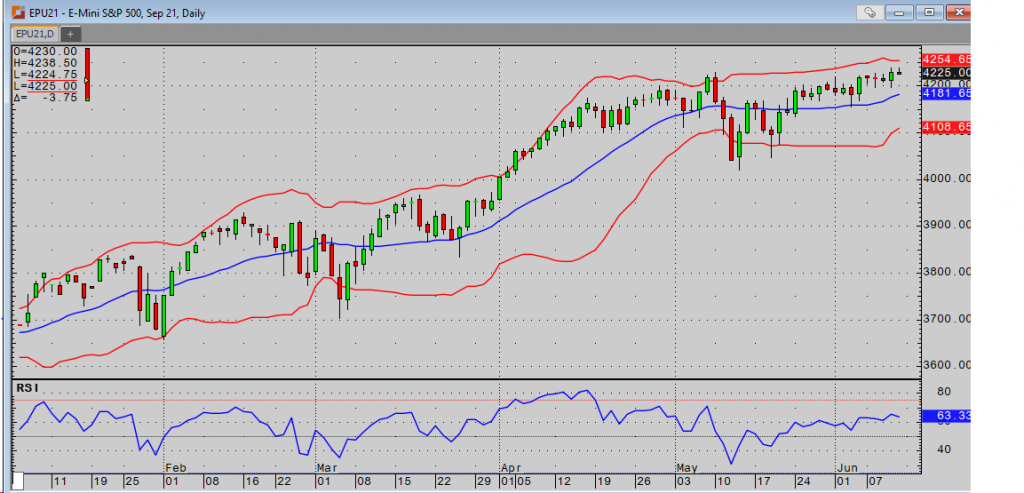

The melt up in indices has continued this week with the S&P printing a new all-time high during yesterday’s trading session. Despite another hot CPI number, markets don’t seem terribly worried about the threat of inflation. Fed Chair Powell has consistently said he views this to be transitory, and perhaps the market agrees. Low interest rates, reopenings, reflation, and jobs numbers that likely keep tapering talks on the back burner for now have been enough to keep this market charging higher.

The news slate today is very light. Consumer sentiment improved to 86.4, which is up 4.2% from last month. With nothing else being reported today, traders will be looking forward to next week’s FOMC meeting. Powell has repeatedly mentioned that he’s not interested in tapering until we reach full employment, and I think the pro taper crowd may be disappointed in what he has to say. That said, other members of the FOMC have indicated a willingness to have the discussion as of late, so perhaps they’ll drop some hints on when they may start to pull the reins back a bit.