This morning’s employment report did not exactly give the bulls something to hang their hat on. We expected to see a reading of 500k jobs added. The actual number was only 245k. We also revised the prior reading lower by 28k. Private payrolls and manufacturing readings also missed expectations and saw previous numbers revised lower. While the news wasn’t the best, stocks continue to trade at or near their all-time highs. Perhaps we’re back into the “Bad news is good news” cycle in which bad readings just mean larger stimulus packages. Speaking of which, stimulus has been back in the news this week as it appears we are getting closer to a bipartisan, Covid-19 relief bill. The word is that the package will be in the neighborhood of one trillion dollars, and both sides seem to be confident something will get passed in short order.

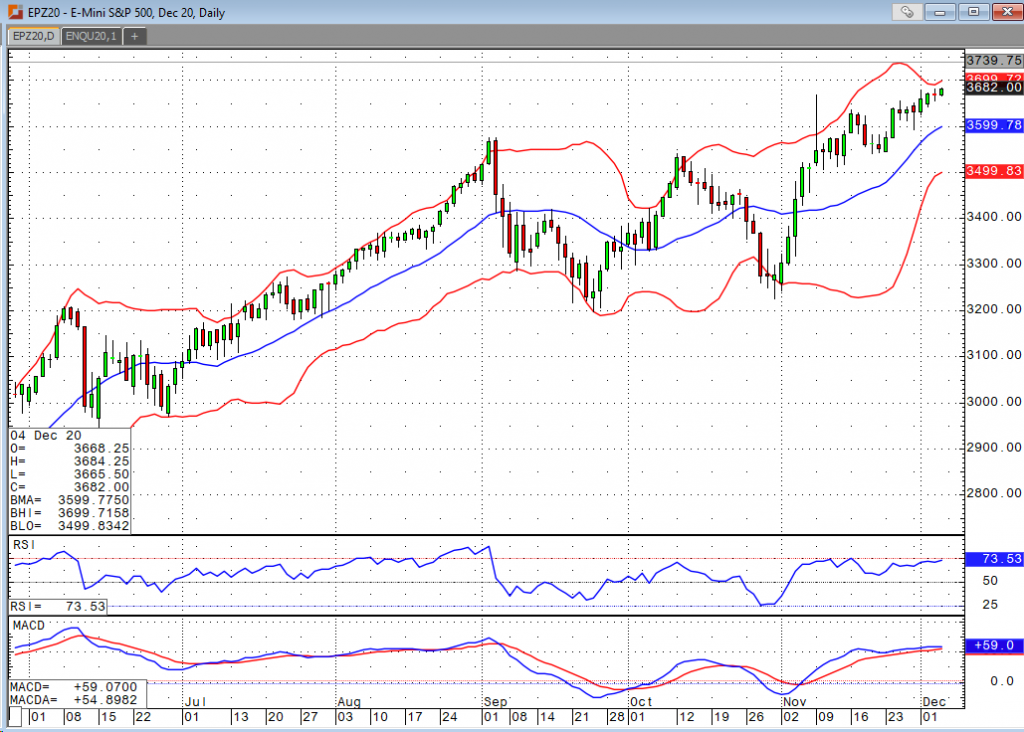

New highs were printed in the S&P and Russell. We’re not far off on the Dow and Nasdaq. Perhaps we’ll see some profit taking to close the week out, but seasonal trends still favor upside. Buyers of dips remain active, and I see little reason for that to stop in the near term.