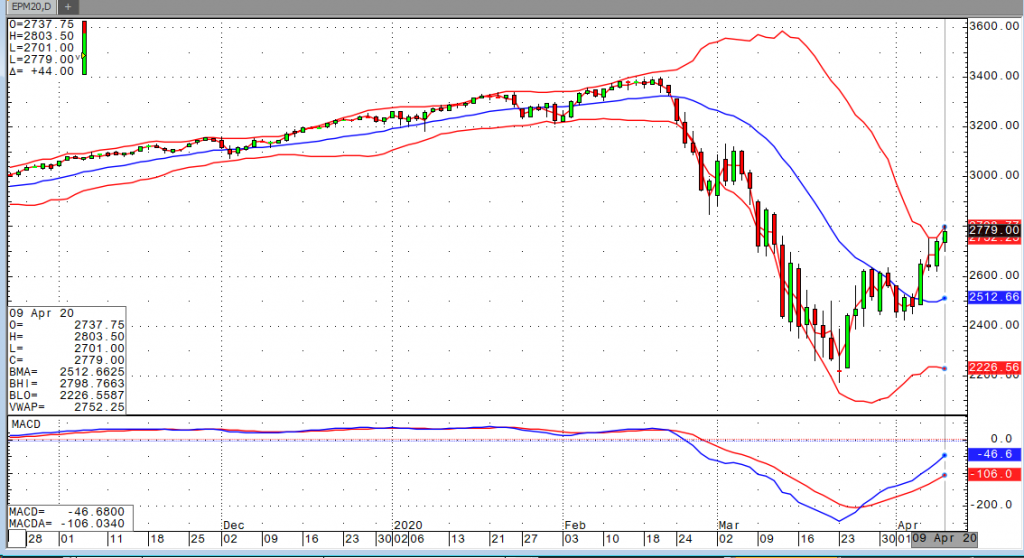

The market looked poised to take a bit of a breather in the early going this morning. The E-mini S&P futures were on their lows just 10-minutes prior to a horrid jobless claims reading of 6.6M. I’m not suggesting that anyone was surprised by that figure, but one would think that such a number would start to apply the brakes on the rally we’ve seen over the past couple weeks. That very well may have been the case, but the Fed came to the rescue yet again with news of a stimulus package totaling up to $2.3 trillion. The markets discounted the jobless claims data and printed new highs for the recovery on the announcement.

The move has taken the E-mini S&P futures above the 50% retracement level of 2785.75 for the June contract. We can argue about the sustainability of this rally given what are likely to be lasting effects of this shutdown. One thing that’s for certain though is that it’s awfully tough to fight the Fed and the kinds of measures they’ve taken. Markets are closed tomorrow. Please continue to be safe, and enjoy your long weekend.