Stock indices are all up over one percent in the early going of today’s session. At the FOMC meeting back on December 19th, Fed Chair Jerome Powell suggested that the United States economy is slowing and cast some doubt on the previously stated intentions of the Fed to raise somewhat aggressively in 2019. This further confirmed what many economists had been forecasting, and the market continued its decline to levels unseen since March of 2017.

An article in this morning’s Wall Street Journal suggests that The Fed may be close to ending its portfolio wind-down. We’ll see if this indeed turns out to be the case, but it has been enough to pump the breaks on this week’s downturn and recoup much of the losses. The next FOMC meeting takes place next Wednesday, January 30th. We’ll also see Q4 GDP that morning, so it is likely to be an eventful trading session. Several analysts are suggesting that we’ll come in well below the prior reading of 3.4%. It will be interesting how the market responds in the event GDP comes out weak and the Fed suggests in the midst of ending their tightening policy.

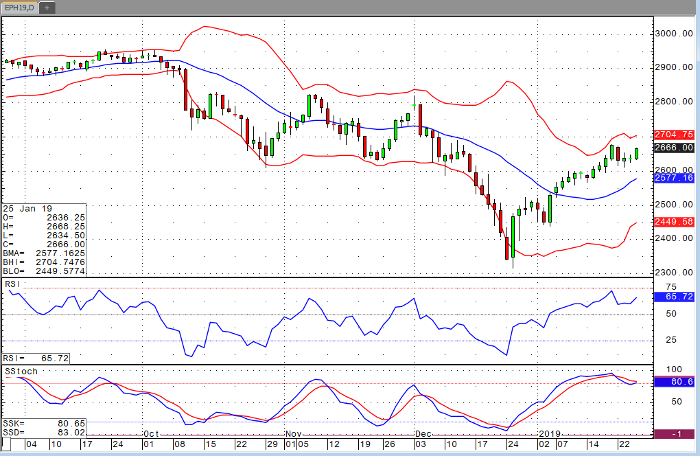

E-Mini S&P 500 Mar ’19 Daily Chart