The four major indices are all higher and well off their overnight lows in the early going this morning. Yesterday’s weak close carried through into the overnight session. News regarding the China deal (or lack thereof) has been dominating the market. Any rosy tweets, comments, etc. have been the all the bulls need to send this market higher. Any negative news, and the bears are taking the reigns. After reports out of China that they were less than thrilled with the United States’ approach to the deal, we continued lower overnight.

Countering a good deal of the bearish China developments is the Fed’s dovish shift. Expect to hear a great deal of speculation going into the two day meeting beginning June 18 about potential rate cuts. They’ve already changed their tune considerably on their stance for further rate hikes moving forward, so it is not inconceivable to think they may transition further towards actual rate cuts. It will be interesting to see how these two major factors continue to develop over time.

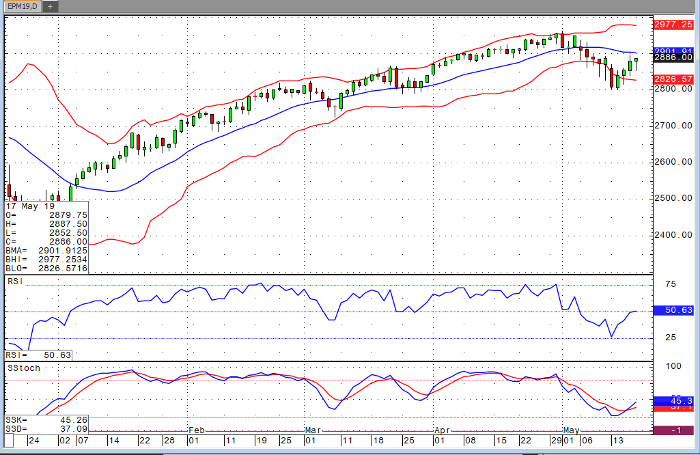

E-mini S&P 500 Jun ’19 Daily Chart