The indices are all slightly positive this morning following the opening bell. Retail sales came out weak this morning (Only 0.1% vs 0.4% exp), but July’s numbers were revised higher (0.7% up from 0.5%), which offset the bulk of the miss. The majority of the weakness in the August data can be attributed to misses in the auto and retail sectors. Import Prices came in weaker than expected (-0.6% vs -0.1% exp). The stronger dollar obviously played a role in the numbers, but most of it can be credited to a selloff in crude oil prices. Industrial Production came in right in line at 0.4%. Consumer Sentiment and Business Inventories will be released shortly. Next week’s news slate is fairly light, but it will feature a good deal of housing numbers.

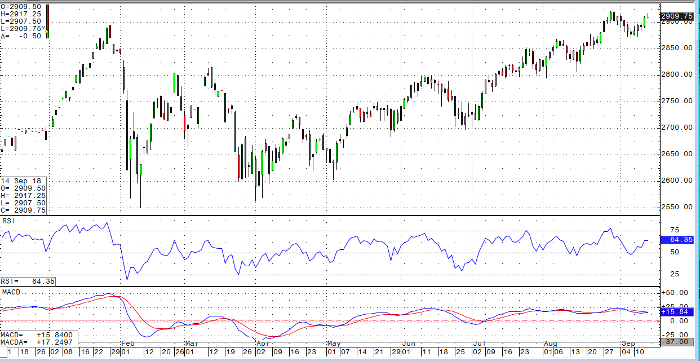

December mini S&P futures hit the all-time high print earlier in the session before backing off a bit. Without more data this afternoon, I’m not sure we’ll be able to print new highs, but we’ll see what happens. The fact that is even in the conversation given the ongoing tariff situation leads me to believe that we’re not terribly far away from coming to some kind of an agreement there.

E-Mini S&P 500 Dec ’18 Daily Chart