The indices are extending the sell-off that began yesterday (The min Dow was able to close positive by 2 ticks, but was off the highs by 84). The Dow remains the strongest of the bunch again, but that isn’t saying a whole lot considering it is down 160 (0.6%). We’ve seen quite a rally since bottoming out two weeks ago, so it isn’t necessarily surprising to see a bit of profit taking ahead of the weekend, with stocks also showing some overbought readings.

Yesterday’s FOMC announcement went as expected, and rates were left unchanged. As of now, we are expecting to see another quarter point hike when they get together again in December. Both PPI and consumer sentiment came in above expectations, and the remainder of the day holds little by way of economic data. Most markets will have regular electronic trading hours on Monday, but there will be some pit closures in observance of Veterans Day.

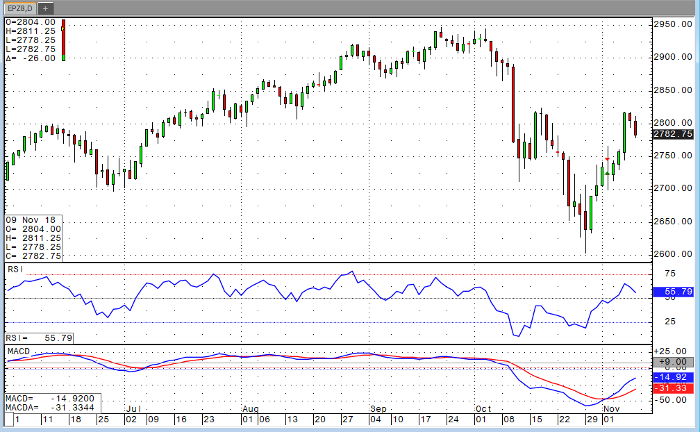

E-mini S&P 500 Dec ’18 Daily Chart