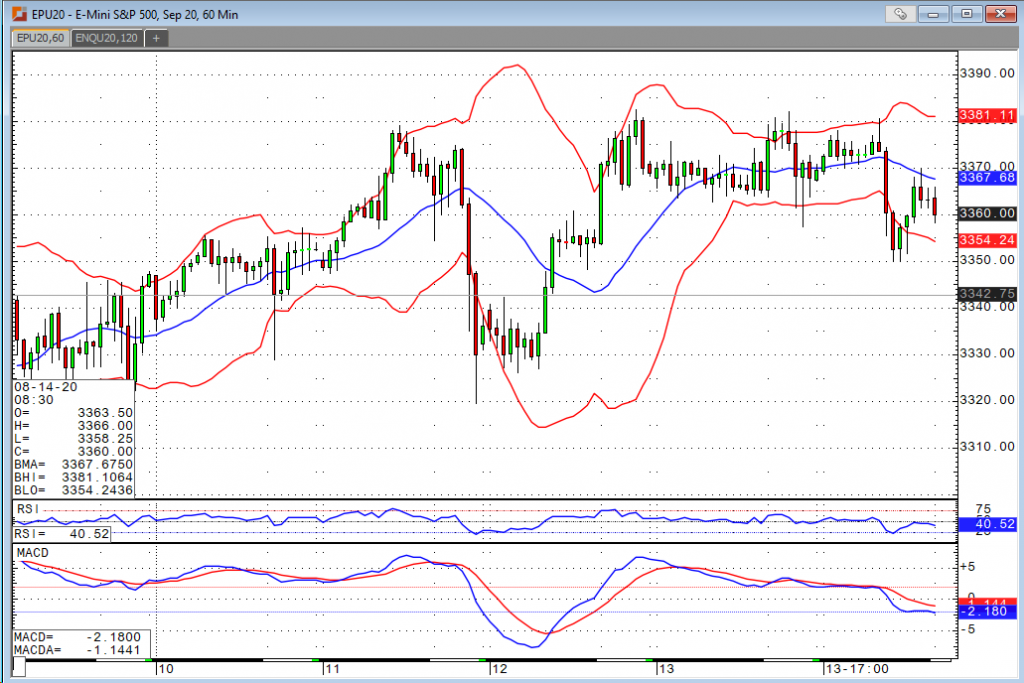

The four major U.S. indices are all struggling to print new highs and have seemed to establish solid levels of resistance this week. Following Monday’s and early Tuesday’s trades, I thought we were likely to see a new all-time high in the mini S&P. However, the trade has been rangebound ever since with the market having issues around the 3380 level. We’re seeing overbought readings from several technical indicators, and while we’ve struggled to continue the push higher this week, the selloffs haven’t been all that impressive either. This morning’s retail sales number was a bit mixed. We revised the prior reading higher but missed on the month over month change (1.2% vs. an expected 2.0%). The number less autos was a bit higher than estimated 1.5%, coming in at 1.9%. The data has sent the markets on a downward trend from where they were trading prior to the reading, but we’ll see how the rest of the day shapes up. Consumer sentiment is on deck at 9 CT, and consensus is expecting a reading of 71.9.