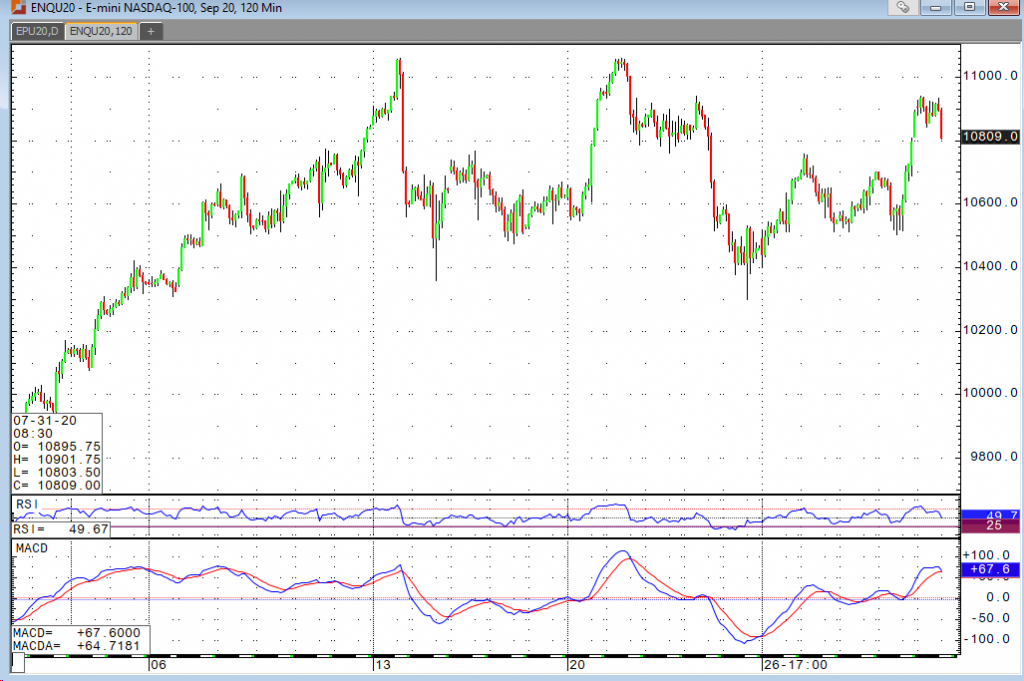

The Nasdaq and S&P are on the rise again following the blowout earnings we saw from the usual suspects in tech. The Nasdaq had been spending the majority of the month in a range (10500-10750) within a range (10350-11050) and is now testing the upper limits of the latter. With earnings figures like we saw yesterday, don’t be surprised if the index prints new highs in short order. The Dow and Russell are the debbie downers of the group, up a measly 0.1% and down 0.5%, respectively. Perhaps they’re having a hard time being optimistic after seeing a GDP reading of -32.9% yesterday, coronavirus numbers continuing to climb, unemployment numbers on the rise, and tensions with China elevating. The overall market continues to discount much of the causes for concern, and why not? The Fed will save us, right? Well so far, the answer is overwhelmingly yes. Powell suggested that they intend to keep rates as is through 2022 and possibly beyond. He also suggested that QE is here to stay and that they’ll continue to inject liquidity as they see fit for the foreseeable future. Fighting the Fed is a great way to lose money, but I can understand the uneasy feelings that many investors are struggling with. Also keep in mind that we’re likely to see another stimulus package here soon. There’s a lot of posturing going on, but that’s nothing new.

Unemployment benefits are going to get extended. We’re just not quite sure for how long just yet. The deadline is midnight tonight, so maybe we get news on that today. With all that in mind, we continue to look for opportunities to buy dips. At some point or another it will stop working, but until then, that is the plan.