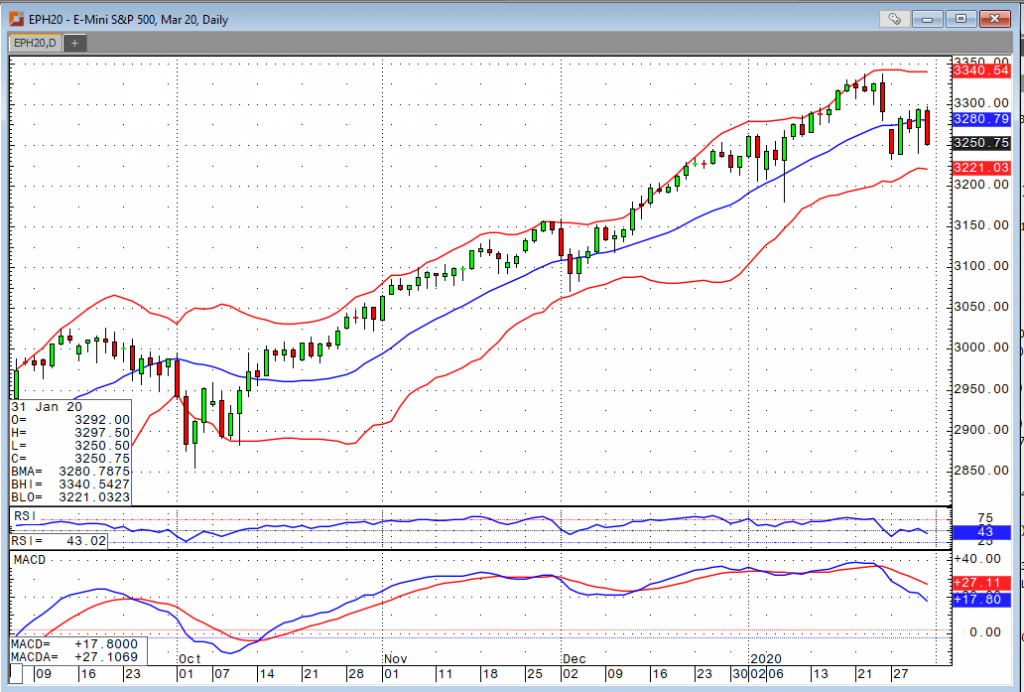

After strong closes for the major indices yesterday and blowout earnings from Amazon after the bell, one may have thought we would be seeing some follow through to the upside. The Dow, S&P, Nasdaq, and Russell all managed to briefly eclipse yesterday’s highs in the evening session but were unable to hold the rallies. Shortly after the opening bell, all four are down over one percent already, but they still have a bit of work to do if they’re going to register new lows for the week. The sell-off is being largely attributed to uncertainty regarding the recent outbreak of the coronavirus and how it will impact things moving forward.

Current updates on the Coronavirus indicate we’re now at approximately 200 deaths (all in China) and around 10,000 reported cases worldwide. Here in the United States, we have just six confirmed cases. With confirmed cases now in over twenty countries, the World Health Organization came out yesterday saying the outbreak was a global emergency. They’re suggesting that the virus is highly contagious, and it can take up to two weeks before symptoms are noticed. With that in mind, it seems like it could be a good while before we’re back to business as usual. Participants should monitor the situation closely as this slide is likely to continue in the event the numbers accelerate over the weekend.