Following Wednesday’s dovish statements from the Fed, stocks have displayed a mixed reaction. Powell suggested that the balance sheet runoff would end in September, they’re lowering their GDP outlook, and there would be no hikes for the rest of this year. They also suggested there would only be one rate hike in all of 2020 and 2021. All of this continues the transition from a hawkish to dovish Fed, which has many believing that the next change in rates will be a cut rather than a hike.

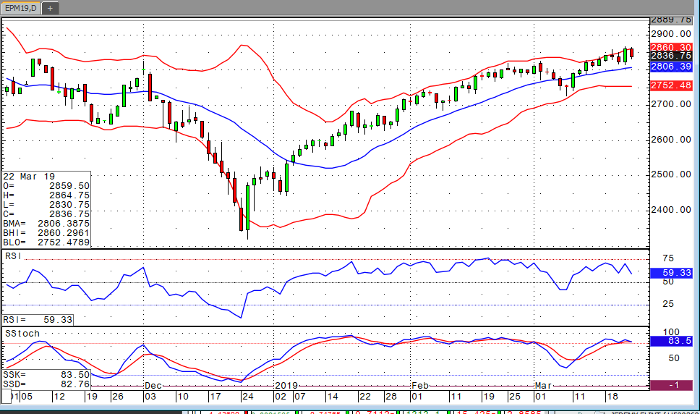

From a technical standpoint, the mini S&P is now trading slightly above the triple top we saw in the fourth quarter of last year. The Dow is struggling right around those levels, and the Nasdaq is trading well above them. Volume on the rallies hasn’t been all that impressive, but all those looking to buy dips haven’t had a whole lot of opportunities to get in as bulls continue to ramp this market higher.

Next week’s slate of news is something you will want to pay attention to. There is a lot of housing data, consumer surveys, and auctions. The biggest number will GDP on Thursday, March 28th. The Fed has already indicated they expect the number to be closer to 2%, and there are rumblings out there that the Q4 reading may also be revised lower.

E-Mini S&P 500 Jun ’19 Daily Chart