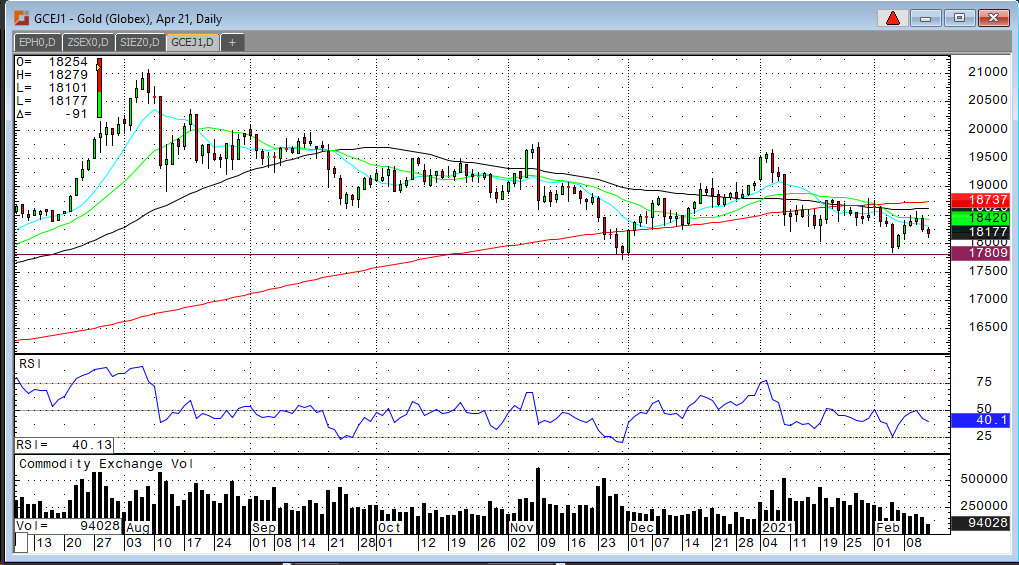

Every time it looks like a recovery in gold prices is coming, it rolls back over. Let’s face it. This market has been sideways with a slightly downward slope for the past six months. So, since my last writing one week ago when I called for a test of the $1,750 level, not much has changed. April gold rallied to $1,856.60 and today we’re back around $1,815. The path of least resistance is still down. Lower physical demand from India and a little bounce in the dollar and suddenly the chart points down again. April gold is very close today to a “tipping” point. At the time of this writing, the low of the day is at $1,810.10. A close below $1,810 would be a negative and perhaps encourage additional selling.

While I do remain long term bullish, I also remain cautious. You must trade off what the charts are saying…not your heart. Third and fourth quarter of 2021 will likely see gold prices above $2,000. I want and encourage my clients to have long side exposure in metals. Again, there’s just too much money out there and slowly the economies around the globe begin to open. We are seeing signs of inflation creeping in regardless of what you here on the news. Once we embrace inflation, gold prices will explode. Perhaps all this sideways trading is actually basing a long term bottom…