I think at this point it’s safe to say that commodities as a whole have bottomed. At the very least, there is a limit to how much lower prices can go while the upside potential is to reach pre-pandemic levels and in some markets like gold, possible all time new highs. Other precious metals like silver and especially platinum is severely undervalued versus gold prices.

I can see soybeans easily reaching $9.00 to $9.50 just by building in some weather premium and lower than expected ending stocks in soy. Not to mention the very real threat of corona virus spread though Brazil. The November soybean contract has been bouncing around $8.40 to $8.60 for the past five weeks. That is bottoming action. I like new crop beans to move above the $9.00 level.

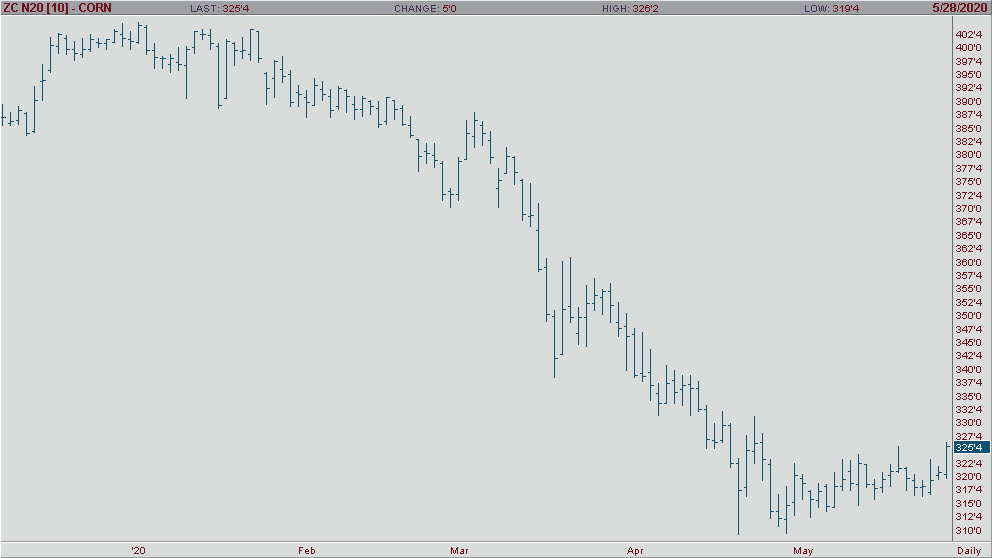

Corn has also been bottoming and can move back towards $3.60 to $3.70 in December contract.

Energies are like to move back towards pre-pandemic levels led by gasoline demand as the economy begins to reopen and unleashes all that pent-up demand.

Metals are being led higher by gold since it will be a long time before the Fed will even begin to normalize interest rates. Gold should challenge the $2,000 level making all time new highs. Silver and platinum are nowhere near their all-time highs and therefore have the greatest upside potential. Platinum is my “best” pick for my clients.