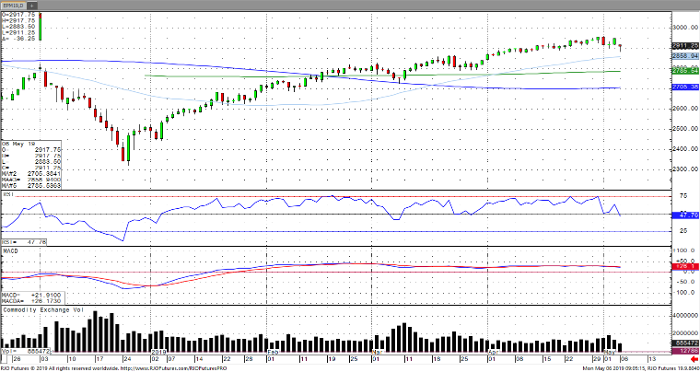

Global equity markets fell in the overnight with the Shanghai Composite down 5.6% and the Shenzhen falling 7.4%, both with their biggest single day declines since 2016. This comes amidst an escalation of U.S.-China trade tensions as President Trump threatened to increase tariffs on $200 billion in Chinese imports up from 10% to 25% with an additional $325 billion in goods potentially subject to new trade tariffs. Chinese delegates are still expected to arrive in Washington later in the week with what was expected to be a ‘final round’ of negotiations. Coupled with recent headlines are a slew of Chinese economic data, European PMI as well as US inflationary data set to be released later in the week. Despite coming off the all-time closing highs of 2945, the S&P 500 remains bullish trend with today’s range see between 2890 – 2954.

E-Mini S&P 500 Jun ’19 Daily Chart

If you would like to learn more about S&P 500 futures, please check out our free Trading E-mini S&P 500 Futures Guide.