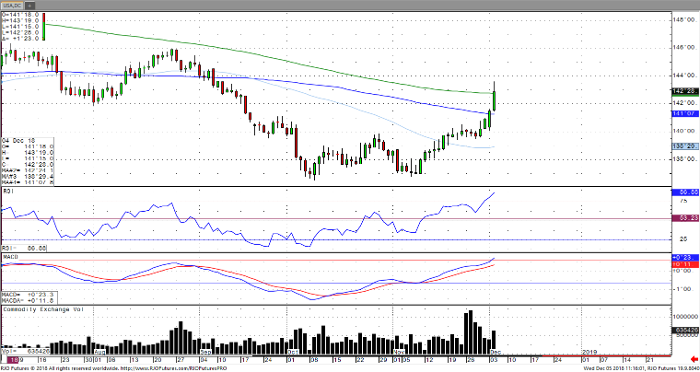

U.S. bond prices continued to move higher on Tuesday as the yield on the 10-year note fell to 2.915% after hitting a seven year high of 3.23% on Nov 8th. This comes amidst a sell-off in the equity market as concerns remain involving the outlook for US economic growth. The gap between the two and five year yields inverted on Tuesday following Monday’s inversion of the three and five year yields. The gap between the two and ten year narrowed to 11 basis points, the smallest difference since 2007. This difference between the shorter and longer term yields are often closely observed as short-term rates have exceeded long term ones before every recession since 1975. Despite being viewed as a recessionary indicator; this shift could be reflected in the Fed officials most recent comments indicating that interest rates may be just below the ‘neutral level’ with further direction expected regarding a pause in monetary tightening at the conclusion of the policy meeting on December 19th. The 30-year bond market is immediate-term overbought with support coming in around 141 – 10 with the next upside target around 144 – 09.

30-Yr T Bond Mar ’19 Daily Chart