U.S. government bond prices moved slightly higher Wednesday following U.S. midterm election results. Yields on the 10-year briefly matched its yearly high of 3.248% on the idea that continued Republican control of the House would improve the chances of more tax cuts as well as increases in spending. This comes amid a near monthly high in the 10-year yield on Friday following reports that 250,000 jobs were added in October and that average hourly wages rose the most in almost a decade. Average hourly earnings rose 3.1% year over year and unemployment remained at 3.7%. Incoming data will continue to provide signals as to whether the labor market is tightening, which would generate wage inflation and support the Fed’s initiative to gradual raise interest rates through 2019. Moreover, it will be important continue to monitor energy prices, specifically oil, which if continues to slide, will deflate inflation expectations and increase interest in long term treasury markets. The Treasury is expected to issue nearly $1 trillion in debt this year, which would be the most since 2010. This increase in supply as well as the hawkish Fed have been observed as contributors to the rise in yields. Although the Fed is not expected to raise rates at the conclusion of the two-day policy meeting on Thursday, attention will be on the language surrounding further rate hikes. Near term support for the December bonds comes in at 136 -30 with the next upside target around 138 – 24.

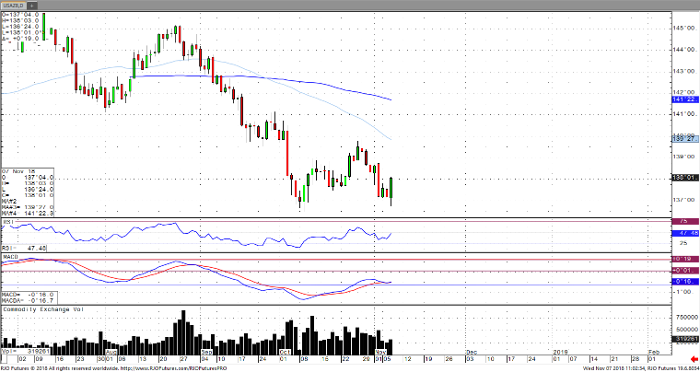

30-Year T Bond Dec ’18 Daily Chart