U.S. Treasury prices are building of this week’s move and are edging higher after falling four out the previous five sessions with the benchmark 10-year US T-note falling below 2.70%. The Bank of Canada held rates steady at their latest polity meeting at 1.75%, citing slowing domestic and global growth. U.S. data released in the early morning showed the U.S. private sector added 183k jobs in February, slightly below expectations with nonfarm-payrolls set to report on Friday. The Fed’s beige book is set to be released later this afternoon. The yield remains bearish trend with the current risk range on the 10-yr seen between 2.60 – 2.77%. Resistance for the June 30 – year bond is seen around 145-07 with support seen around 143-22.

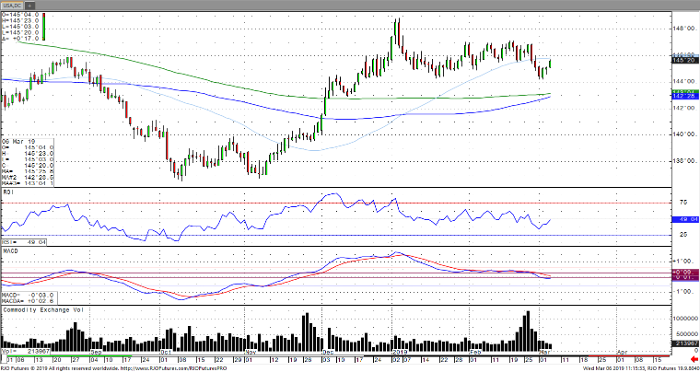

10-Year Treasury Chart

If you would like to learn more about interest rates, please check out our free Interest Rates and the Economy Guide.