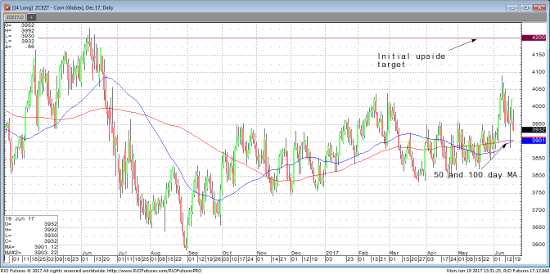

The corn market closed down roughly 2.5% today, mostly due to much needed rains in the eastern half of the corn belt. We are expecting moderate temperatures and decent rain fall in the 10-day forecast which is also adding some pressure. Crop conditions are lower than both last year’s and the 10 year average at 67% good to excellent. This week’s update good be a catalyst to move the market. If there’s no change in the condition, we should see December test $4.00 while an uptick in condition could add selling pressure, causing the market to test $3.90, both it’s 50 and 100-day moving average. Ultimately, the downside is very limited this time of year and should be looked at as a buying opportunity. If we see a hot and dry July the market should go above $4 triggering some momentum to the $4.20-4.50 range. While we are seeing minor short term bearish fundamentals, I believe the longer term fundamentals point to higher corn. The plantings were delayed in most Midwest areas due to too much rain, while other areas in the south were extremely dry and hot. In the very wet areas the crop will more than likely have a shorter root system which won’t be able to withstand adverse weather. The bottom line is that both fundamentals and technicals are mixed right now, but in my opinion there is substantially more upside than downside at these current price levels.

Dec ’17 Corn Daily Chart