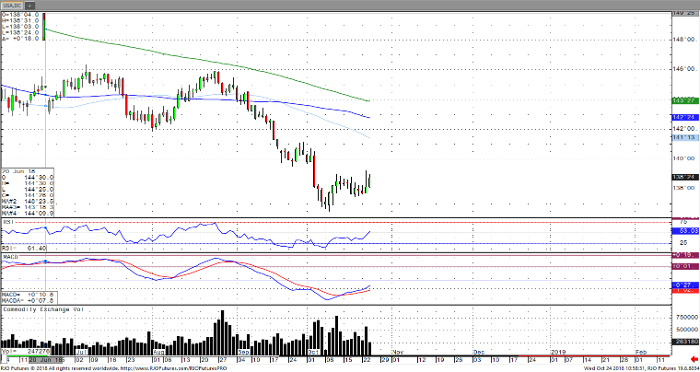

Treasury prices continue to move higher amid the continued sell-off in U.S. equity markets, with recent lackluster corporate earnings as well as concerns involving China’s economy and Italian debt providing support. Yields have been weighed down by the recent move by the People’s Bank of China to support financing for the private sector, Italy’s continued dispute with the EU regarding a budget that violates fiscal rules as well as missed earnings from industrial giants 3M and Caterpillar. Fed officials continue to remain hawkish with a fourth rate expected in December as they attempt to ensure that the economy does not overheat while managing inflationary pressures, despite recent weaker headline inflation readings. Concerns remain regarding comments from Fed officials that they could continue to raise rate over the ‘so called neutral level,’ which may in turn may become restrictive and slow growth. Recent price action alludes to the idea that a bottoming process may be in place with bond prices one of the most heavily shorted, according to the CFTC. The initial upside target in the December bonds is seen at 139-00 with the next target near the September consolidation low of 139-17.

30-Year T Bond Dec ’18 Daily Chart