Hawkish Fed. Dovish Fed. Tariffs on. Tariffs off. Impeach Trump! Big jump in non-farm payroll positions! How are you supposed to trade this market volatility? I think weekly options in the E-Mini S&P are an excellent vehicle for navigating these markets in the current conditions of big swings up and down.

All of us who pay attention to the markets on a daily basis, have known for years that stocks have been propped up by historically low interest rates and that has gone on for far too long. However, over the past two years the stock markets have been able to rally while the Fed has been slowly rising rates. The “Trump” rally! Stocks and all bull markets need to have corrective pullbacks to test the markets strength. The market is strong. The U.S. economy is strong. The U.S. labor market is strong. Investors now have more options and ability to diversify their investments in markets other than stocks! That’s all that’s happening right now. I don’t see a recession on the horizon. The current market volatility is being driven primarily by all the conflicting “headlines”. Big swings are not normal, but it is not normal to have interest rates as low as they have been for that extended amount of time and then not have a negative reaction as rates finally begin to normalize.

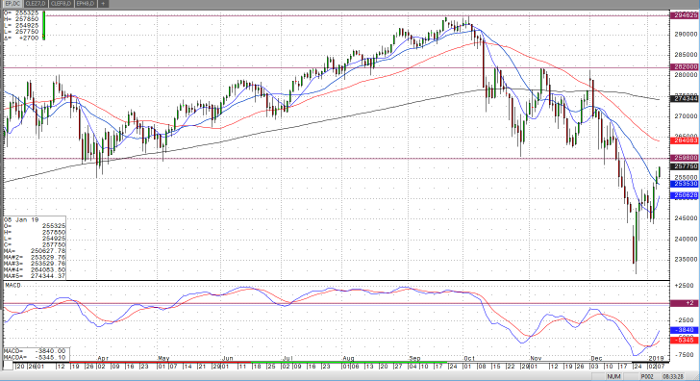

E-Mini S&P Daily Continuation Chart