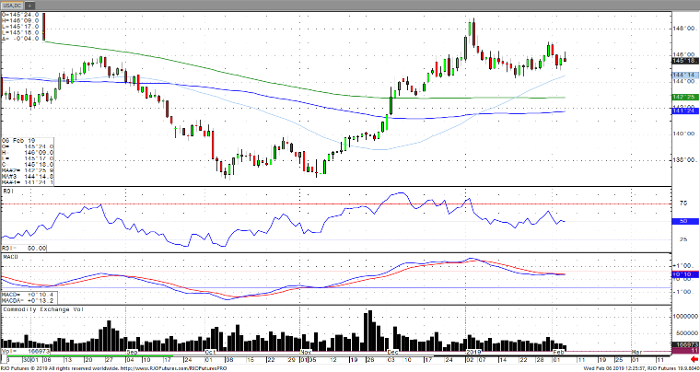

U.S. government bond prices continue to move higher on Wednesday for the second consecutive session with the 10-year yield falling to 2.691% after settling at 2.702% on Tuesday. This comes following the Federal Reserve’s dovish tilt and posture on interest rates as well as decelerating growth data in the U.S. and Germany. ISM Services Index for January reported its non-manufacturing purchasing managers index fell -1.3 pts from 58.0 to 56.7 with the leading component, an index of new orders, falling -5 pts from 62.7 to 57.7. Export orders fell -9 pts to 50.5 from 59.5, the largest sequential decline and lowest level in two years, which is only slightly above the 50 reading that indicates expansion. German manufacturing data in the overnight showed Germany’s construction PMI falling to 50.7 with factory orders falling -7% year over year, only exacerbating the recession risk in the EU. Later on Wednesday, the US Treasury will be auctioning $27 billion in US in 10-year notes, which is expected to be met with good demand. Near term support for the March 30-year treasury bond comes around 145 — 06 with resistance around 146 – 08 and the next upside target around 146 – 21

30-Yr T Bond Mar ’19 Daily Chart