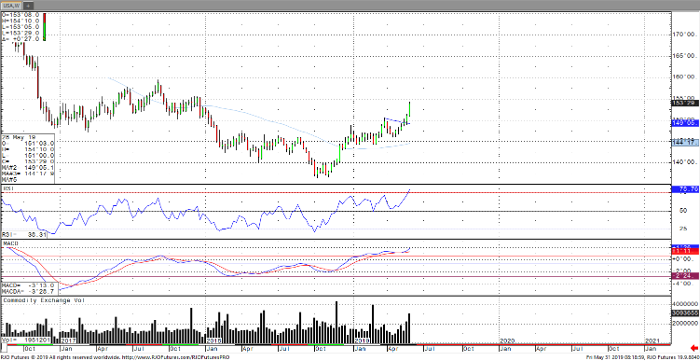

U.S. government bond yields continue to press lower amid an announcement of U.S. tariffs on Mexican goods with the yield on the benchmark 10-yr declining to 2.158% from 2.227% on Thursday, falling to a 20-month low. Concerns involving global growth were only further exacerbated this morning following a negative print in Brazilian and Italian GDP, a decline in South Korean and Japanese Industrial Production growth as well as a miss in Chinese manufacturing PMI data as New Orders fell below 50. Treasury yields are now down 33 bps for the month, with the 3M-10Y yield was inverted as much as 21bps. Geopolitical safe haven buying continues despite being immediate term overbought with the U.S. 10-yr remaining bearish trend with the current seen between 2.18 – 2.41%. Near term resistance for Sept t-bonds comes in at 153-20 with the larger upside target seen perhaps near the 2017 highs.

30-Year Bond Sep ’19 Daily Chart